Author(s): Pavan Kumar Joshi

The usage of cloud solutions in financial systems has opened up advanced solutions with scalable and efficient technologies. Merchants cannot afford any form of disruption when it comes to receiving payments; hence, payment gateways should exhibit high availability, security and performance. Other such demands have grown to be addressed by Azure Functions, which is a serverless computing platform. Due to its ability to scale resources and minimize operational costs, implementing Azure Functions in today’s payment gateways offers the best solution. The rest of this paper focuses on an elaborate discussion of Azure Functions with strategic implications for payment gateways. It outlines elements such as serverless architecture, eventing model, and how you can connect with other Azure services, some of which include data storage, API management, and monitoring tools. Also, the paper looks at security features of Azure, for instance, PCI DSS compliance for monetary systems that deal with transaction information. A side-by-side analysis of the old monolithic-like payment gateway services and the newer Azure Functions-based version shows how much cheaper, easily scalable, and easy to implement using Azure Functions, even when compared to other comparable Microsoft products. To do this, the study dwells on cold start challenges and comes up with various features that Azure Functions has that can help bring down latency, such as the Azure Premium plan and direct virtual network integration. In this study, case studies are also provided, where examples of payment gateways using Azure Functions and implementation of such systems, including such issues as deployment topologies, architectural designs, and performance comparison, are provided as well. In addition, the research explores how functions available on Azure improve the robustness of the system by providing failover, redundancy, and scaling up or down automatically. The final section of the paper will include future trends in the payment gateway, which includes the integration of AI for the detection of fraud and the incorporation of blockchain, which can be effectively developed with the help of Azure Functions as tools for the enhancement of payment gateway. Due to the serverless architecture, financial organizations have the possibility to minimize the level of difficulty, which includes the traditional systems.

The emergence and migration of financial services to the online world have created voluminous traffic for online payment, which in turn requires more reliable, secure, and scalable payment gateways. In the past, payment gateways were based on monolithic architectures, and this caused problems like scalability, high costs and also the issue of compliance with ever changing security standards [1-3]. Cloud computing has led to a new shift in system development known as serverless architecture that has affected most industries, including finance. Serverless computing allows developers to work on the code and infrastructure that will be handled by cloud providers such as Microsoft Azure. Azure Functions is a serverless computing service on the Azure platform through which enterprises can run code in response to episodes without worrying about the servers.

Figure 1: Importance of Azure Functions in Payment Gateways

Some of the significant benefits that come with the usage of Azure Functions in payment gateways include flexibility and scalability. The conventional architecture of a payment platform has limitations in flexibility, which are manifested in its inability to stretch, for example, during the holiday seasons or flash sales. This challenge makes businesses allocate resources in excess to accommodate the high-traffic periods; hence, most of the resources and infrastructures remain idle during low-traffic periods, and property expenses increase. Azure Functions offers a way to deal with the problem by integrating automatically scaling with the volume of transactions. It is going to make the required resources appropriate, whether for a few transactions or for millions, and always available and responsive. Also, this serverless architecture is based on the consumption model, while businesses need to pay only for the actual usage, and it increases cost-effectiveness.

Payment gateways are inherently event-based, where every transaction is a sequence of events ranging from an authentication request to authorization and the processing of funds transfer. Azure functions are built to run in such scenarios where the code runs according to some certain trigger, like an HTTP call or a given data update. For example, functions can be distributed to single tasks such as identifying the user’s credentials, checking the balance or informing about some activity that seems to be suspicious. Such an approach improves system flexibility and modularity since payment gateways can handle events effectively without a complex monolithic structure. In addition, this architecture enhances maintainability as different functions can be without having to change the whole system.

Security is one of the most important aspects of payment gateways since the data being processed and transmitted are confidential to the owner, which could include credit card numbers and other personally identifiable information. Array Functions have built- in support for several other Azure security services, such as Azure Active Directory (AAD), Azure Key Vault, and Azure API Management, to meet compliance standards, especially those that require the Payment Card Industry Data Security Standard (PCI DSS). By design, messaging end-to-end encryption is enabled to guarantee general security for all information in transit and at rest. Moreover, Azure Key Vault provides additional security by storing anything that is considered to be sensitive, such as API keys and encryption certificates. Further, functionalities like identity-based access control, Distributed Denial of Service (DDoS) prevention, etc., minimize possible security threats, thereby making Azure Functions a preferred option for organizations, especially payment gateways that consider security compliance of critical importance.

Payment gateways normally struggle to control high operational costs since their infrastructure goes underutilized, especially during off-peak periods. With traditional systems of implementation, large amounts of money are needed for operating servers, no matter whether the number of transactions is high or low. Azure Functions avoids this inefficiency because they charge businesses for their consumption based on how often they run the functions. This results in a lot of savings in costs, particularly for business organizations that undergo a lot of transactions individually. In addition, Azure Functions do not require a company to acquire physical resources and equipment, hence decreasing capital outlays. That way, businesses can maximize their processes where payments are being made on stream instead of having to stress so much about infrastructure management through Azure, which leads to a cheaper model.

Azure Functions can also trigger other Azure services, including Azure SQL Database, Azure Cosmos DBs and Azure API Management, making them appropriate for a payment gateway that needs to engage with numerous third-party services and APIs. These advantages make it possible to have proper management of transactions, tracking, and analysis in almost real-time. For example, upon the completion of a transaction, Azure Functions can update information in an Azure SQL database or invoke an API to process payments for settlements. Furthermore, the Azure Monitor allows business to monitor their payment gateway utilization and their efficiency in operations. This capability helps in making payment systems developed using Azure more compatible with other systems, thereby improving their general operations.

There is always stiff competition when it comes to the offering of financial services, and it is therefore important to launch new features in the market within the shortest time possible. Azure Functions promotes the rapid development approach since developers are able to work on individual task-specific functions. This modularity enhances the development rate since groups can work on different sections of the payment gateway concurrently, hence increasing the rate of development. Also, the Azure Functions support the CI/CD in terms of testing and deployment of new changes to be made monitoring the function. This way, the time to introduce new features is shortened, and maintenance or security incidents or changes in legislation do not tie up the application for very long. The flexibility of Azure Functions is very useful for business enterprises, particularly when the financial market continues to change quickly.

Regarding the pay gateway, the downtime can lead to loss of sales and defaulter customers. Azure Functions provide the feature of load balancing and distributed failure, rather commonly known as redundancy and fault tolerance. Functions can be deployed across multiple regions, thus leveraging the geographical redundancy of Azure’s data centers across the globe. In the case of a regional failure, the traffic is rerouted to another data center, and this helps them not to be disrupted. Also, the load is balanced in Azure Functions and distributed between the function instances; this ensures that the system is not overloaded, especially during the busiest hours. These features are especially significant to payment gateways, which have to provide up-time and reliability no matter the circumstance.

Azure Functions allow payment gateways to integrate these features as today’s payment technologies like artificial intelligence and blockchain become vital. For instance, corporate organizations can combine Azure’s artificial intelligence and machine learning services to launch a real-time fraud control that will enable the identification of fraudulent transactions based on patterns and properties. Other subservices that can be associated with blockchain technology include secure, transparent, and tamper- proof transaction history, in addition to security and trust. One would say that the nature of Azure Functions as a Serverless computing platform also enables payment gateways to implement and scale these sophisticated technologies and services without experiencing abrupt shifts in infrastructures, and this means they will remain innovative in the financial industry.

Azure Functions in Financial Systems: A Comprehensive Overview Indeed, Azure Functions is one of the cornerstones in contemporary financial systems since they provide an efficient serverless solution, allowing scaling up rapidly, minimizing costs, and improving performance [4]. It is important to understand changing demands and various pressures that directly affect financial institutions and payment gateways, including changing traffic patterns, security standards, and the integration of many systems. Azure Functions assists in solving these challenges through the event- driven architectural approach, where financial systems are able to respond aptly to real-time events, thus meeting the objectives of high availability for financial systems, security, and compliance.

Figure 2: Azure Functions in Financial Systems: A Comprehensive Overview

Another key benefit of the financial system embedded with Azure Functions is its serverless model, which enables the company or financial institution to create or develop applications without concerns pertaining to infrastructure. In this architecture, there is no maintenance of servers, as is evident from the preceding paragraphs, but the writing of business logic, hence freeing financial firms to focus on the delivery of services and innovation. Financial systems can have variable loads; maybe, in a day, you have a lot of transactions during specific time intervals or special occasions. Azure Functions also enable on-demand self-service in terms of resources, thus avoiding situations where resources are taken and wasted when a system is inactive. This pay-per- execution model also leads to reducing costs because institutions pay only for the amount of computing power they need.

Event-Driven Processing for Financial Transactions Basically, financial systems are particularly event-oriented in that numerous processes are initiated by activities like customer transactions, account modifications or altering of regulations. Such environments are actually very suitable for Azure Functions since they run code on the basis of certain events. For instance, on payment initiation, an Azure Function can authenticate the transaction, search for fraud, adjust the account of the customer concerned and inform all the interested parties. This event-driven model is more elastic, enables rapid response and increases customer satisfaction because of the short response time of the systems in the transactions. Also, Azure Functions are comprised of smaller and more sub-divided functions embedded in each process, which makes the updating and extension process much more simple and manageable while not compromising the overall financial process.

Any financial system, especially in entities such as banking, trading and payment systems, requires handling large numbers of transactions in real-time. Azure Functions come with the immediate scalability feature so that the systems can be capable of handling large volumes of transactions without any extra effort. No matter whether a user performs 10 transactions or millions of transactions, through Azure Function, it is possible to maintain the same performance. This capability will be most useful for financial services businesses that have predictable, very busy periods, such as during stock market tumbles, festive seasons or sales rush.

Security is a very crucial component in financial systems because the data involved, including customer data, payment details, and transaction data, are very sensitive. Currently, the Azure Functions supports several Azure security tools that include the Azure Active Directory (AAD), Azure Key Vault, and Azure Security Center to support compliance with the required standards such as the Payment Card Industry Data Security Standard (PCI DSS). Azure Key Vault has the capability of storing the application’s secret details like API keys, encryption keys and certificates so that data cannot be accessed by unauthorized persons to financial information. Other features include end-to-end encryption, meaning all the data, both in transit and while at rest, are safeguarded.

In the world of banking and credit card companies or any payment gateways, money fraud has always been a problem. One should consider that integration of Azure Functions with machine learning algorithms and AI tools can help increase fraud detection effectiveness. Using real-time transactional data, it is possible to use machine learning algorithms in order to identify signs of fraud; the Azure Functions can then either stop the suspicious transaction or alert proper security personnel. Real-time fraud detection is crucial to avoiding possible loss and safeguarding customers’ identities and accounts from fraudsters.

As demonstrated by the structure of Azure Functions, there are considerable advantages to using this model for real-time payments and financial reconciliation. The financial systems must balance thousands of transactions across multiple systems on a daily basis to make sure that all the payments, fees, and settlements are reconciled. Azure Functions can assist in this repetition by performing activities such as report generation, transaction checks and synchronization with the ledgers. These operations are normally done offline, and with the use of Azure Functions, they are done in real-time, hence no delays and no human-made errors.

As a number of authors mentioned, delivering customer experience is one of the most important aspects of sustaining competitive advantage in the financial sector. Customer-facing services, including balance checks, loan applications, and account updates, among other services, can be automated with Azure Functions in financial institutions. With the help of integrating Azure Cognitive Services, chatbots, and Natural Language Processing (NLP) tools for Azure Functions, the company can interact with customers in real time. For instance, if a customer wants a loan, the platform can quickly alert the customer whether s/he qualifies for a loan through a machine process facilitated by Azure Functions.

Lending-related financial systems produce enormous volumes of data, including, but not limited to, customer transaction records and market information. Real-time analysis of this data is therefore important for making good decisions. Azure Functions can, therefore, be used to connect with Azure Synapse Analytics and Power BI for the processing of financial data and generation of insights for business use. For instance, Azure Functions can be used to initiate the creation of financial reports and other business performance executive dashboards and visualizations. In addition, automating data processing in Azure Functions saves time that can be utilized for higher-value analysis work.

Payment gateways have evolved a lot since they were first introduced into the world. Earlier, they used to employ only manual and batch-type processing, which involved a lot of intervention on the part of humans and a lot of time. It was a similar case with payments, which were collected during the day, and the outcomes were processed the following day before reporting was made on the business day [5-8]. Though the new millennium posed a significant threat with the advent of the internet in the late 1990s and early 2000s, new automated and real-time transaction systems came in that could handle payments in real time. This transition was made possible through the use of Cloud computing. Cloud- based infrastructures were introduced in the respective industry starting from the early 2000s, allowing payment processors to expand the scale of business growth while integrating flexibility and global capabilities. There was no need for organizations to spend a lot of money on the upkeep of data centres, and through the cloud, the rate of innovation was faster because of the ease of integration of newer features and solutions. However, cloud systems also had great demands, which meant infrastructure was needed for server management and manual scaling. It did this while laying the groundwork for the serverless computing model, which would eliminate these management cost factors. Newer computing models such as Azure Functions, which are serverless in nature, brought more flexibility and scalability to payment gateways and made it possible for even smaller companies to implement highly efficient and near-perfect solutions with negligible overhead.

Recently, with the adoption of serverless computing, there has come a new model of thinking about applications, especially when it comes to event-based systems like payment gateways. Gill & Anderson define serverless computing as a computerized system that enables developers to build and run their applications and services without any need to think about servers, managing or even scaling physical or virtual space. For example, in Azure Functions, the resources are automatically allocated depending on the events that are received, thereby enabling the developers to deal only with business logic. In terms of payment gateways, it means getting faster development cycles as the requisite infrastructure is no longer a concern for development teams. Serverless architectures are also inherently more flexible with regard to design patterns and are modular, scalable, and event-based, which suits the nature of payment processing, which has upward and downward surges. Therefore, new business demands can be met in payment gateway systems, and they can be extended to access external services seamlessly without the overhead of the server-based system. Thirdly, in the practice of DevOps, serverless systems integrate with the continuous integration and delivery (CI/CD) pipeline to make the time-to-market fast but still very resilient, secure and highly available.

One of the significant aspects regarding payment gateway systems is scalability since such systems may be characterized by unexpected fluctuations in the number of transactions. For example, the activity on electronic commerce websites can be high during sales. In contrast, the activity on the websites of financial institutes can be high during high activity in the stock market. A study by Roberts et al. explained that with Infrastructure as a Service, such as Azure Functions, the platform is elastic in that it scales resources to fit the current transaction loads without any need for action by the user. This is unique from traditional architectures, where scaling is usually a process of adding more servers or more virtual machines, and such tasks are done automatically by the serverless platform. It is the on-demand scalability that makes the payment gateways to be able to handle high levels of traffic without any chances of failure due to traffic congestion. Also, with serverless platforms being offered based on usage or consumption basis, organizations only end up using the resources their applications demand in low usage periods. This means that serverless architectures are 25% cheaper than traditional models and serve businesses with fluctuating usage. Lack of use means that it can be scaled down to zero and that it decreases operational costs, an aspect that would interest most enterprises, especially those in industries where infrastructure costs matter a lot.

One of the key requirements that need to be met in financial systems considered as payment gateways is security, which is a major requirement given the types of information being processed, namely, the financial and personal data. From this perspective, Singh and Kumar pointed to a group of issues noting that if any system deals with payments, it must adhere to legal requirements including but not limited to the Payment Card Industry Data Security Standard (PCI DSS). Azure Functions are well supported by other services in the Azure environment, including, for instance, Azure Active Directory when it comes to identity, Azure Key Vault when it comes to storing cryptographic secrets and credentials, and Azure Security Center for real-time detection and response to service threats. End-to-end encryption, tokenization, and strict access control added an additional layer of security that made it almost impossible to infiltrate the payment data during its transmission or storage. Tokenization, particularly, replaces payment details with tokens that are only usable in the payment system, thus lowering the risk of hacking. Moreover, multi-factor authentications (MFA) help to protect users since they have been designed in a way where even if one layer of protection is exposed, a user cannot be logged in. Thanks to Azure’s global compliance certifications, Azure Functions also help organizations meet compliance requirements in different regions.

The great majority of payment gateway applications have been built following monolithic architectural strategies that encapsulate all provided segments as a singular entity. A study that Brown conducted is useful in demonstrating the trend of migrating from architectures to serverless models such as Azure Functions. It also implies that monolithic systems need to be manually scaled, making organizations have to add more resources – oftentimes very expensive- to accommodate spikes in traffic. Serverless solutions, on the other hand, continually adjust upwards or downwards based on real-time usage, hence avoiding situations such as over-provisioning of resources or even manual creation of extra resources in anticipation of increasing workload demand. Also, monolithic systems are more challenging to upgrade and sustain because even a small alteration in one section of the system will require modification across the entire system. Serverless architectures disintegrate applications into multiple functional parts and hence make it easier to upgrade, test, and deploy. This modularity also decreases the availability time since a problem in one part does not affect all the other parts of the application. As for price, it is worth noticing that serverless solutions are perfect for organizations that adhere to the pay-per-use model. This is quite in contrast to the so-called traditional architectures in which resources have to be preallocated and kept running even when idle. Serverless solutions such as Azure Functions thus provide a more economical and robust pattern for payment gateways, especially with the rising trend concerning microservices and event-driven financial systems.

This work compares traditional payment gateway architectures with those developed with the help of Azure Functions using a comparative analysis approach [9-13]. Primary data collection is also done in this study, comprising both qualitative and quantitative data from case studies of different payment gateway companies incorporating Azure functions in the e-commerce, finance, and telecommunication industries. Such case studies help to understand the enhancement of the scale, security, performance, and cost of these systems with the help of Azure Functions. Surveys with specialists in the IT sphere and system architects, as well as the evaluation of the operative data received in the process of payment transactions, will be conducted to check the practical usage of Azure Functions. The measured factors include aspects like system performance, operational overhead, security index, which compares with relevant security standards, and costliness compared to the traditional server-based model.

Azure Functions works on a serverless model, which basically focuses on the event-driven approach. This architecture is more appropriate, especially for payment gateways, because it adapts to events that occur, such as transaction requests, payment confirmation, and even fraud alerts. Azure Functions are invocable by a range of sources, such as an HTTP request, a change in the database, or a message on a queue, such as Azure Queue storage and Azure Service Bus, among others. Another benefit which could be mentioned while using Azure Functions is versatility because functions can be automatically scaled. Whenever there is a transaction request, an HTTP trigger will help to call the function that addresses that payment. This function is also responsible for transactional processing in terms of encoding and validation, as well as connecting to other payment services through application programming interfaces API and storing the command reliably in one or several databases. The architecture also entails monitoring services that allow one to check the vitality of the payment gateway and check for any inconsistencies that may be unlawful or cause a system breakdown.

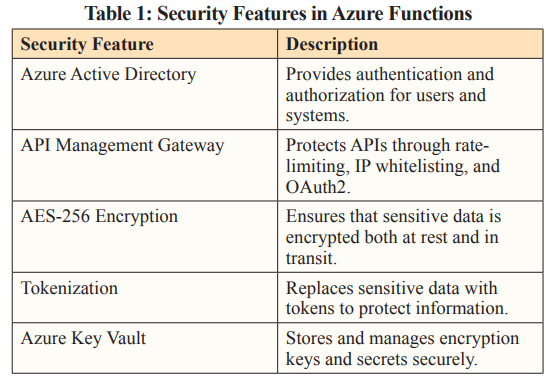

Security is an issue that must be accorded the utmost importance when it comes to payment gateways and this is an area in which Azure Functions provide multiple layers of security in order to meet PCI DSS standards. This research examines the implementation of the following security features in Azure Functions-based payment gateways:

Figure 3: Security Implementation

Azure Active Directory (AAD) is a Microsoft cloud service that allows users to manage identity and access control for the applications and resources in Azure Functions. In payment gateways, AAD guarantees that only the permitted users and systems can view some restricted data or perform key operations. It permits flexibility in the authorization procedures for several aspects of the payment system because it adopts a principle of roles. AAD also connects with MFA, which adds more security details by requiring the second method of verifying the identity of the user, for instance, through an application on your mobile phone or through a text message, so as to minimize the cases of impersonation.

An extra layer of security is provided by API Management Gateway, especially when handling and shielding APIs associated with payment gateways. Its available features include rate limiting that helps to guard systems against many requests at a given time and IP whitelisting for allowing requests only from trusted sources. OAuth2-based authentications are also implemented in the API gateway to confirm that external services that are in contact with the payment system are authorized and safe. This will help to keep the ill-intentioned in check and will secure APIs that interface with payment services, third-party applications and client servers from unwanted access, including attacks such as DDoS.

Azure Functions encrypt the data in two ways: data at rest and data in transition in order to enhance the security of payment details. Databases such as Azure SQL or Cosmos DB will encrypt data using AES-256, which is a very secure encryption standard; in case the data gets out, it will just be read out as garbage data due to decryption keys. Transmission in Azure Functions employs Transport Layer Security, TLS, to encrypt the data as the interaction between the client, API services, and databases occurs. These encryptions are important in protecting the payment data so that they meet the objective of confidentiality and data integrity in host financial system payment information like credit card numbers and other personal details.

Tokenization is a security process that involves substituting actual payment details like credit card numbers with other comparable data termed tokens. Such tokens can be securely passed through systems and utilized for payment transfers while the actual data remains protected. Tokenization in Azure Functions-based payment gateways reduces the effect of data breaches by preventing credit card or payment details from being handled or stored in unsafe areas. Tokenization is consistent with PCI DSS compliance because it greatly minimizes the risk of sensitive data exposures, which strengthens security all through payment transactions.

Azure Key Vault is a cloud service that provides storage and management of securities such as encryption keys, secrets, and certificates. Microsoft Azure Key Vault, when used in conjunction with Function App that works in payment gateway, enables the protection of cryptocurrency keys and general safeguarding of payment information. This makes it possible to implement high levels of security to access the keys and the way that they will be used in the organization. The integration ensures that encryption keys are held separately from the data they are protecting; this additional layer makes it easier for any organization that is facing compliance challenges, such as PCI DSS, to meet them.

In order to measure the effectiveness and costs of deployment of Azure Functions in payment gateway solutions, benchmarking tests were conducted on essential key values, including cold start latency, average transaction time and resource consumption [15-18]. These metrics were then benchmarked against typical server-based architectures so as to compare and contrast the gains that can be earned from the serverless paradigm.

Figure 4: Cost/Performance Indicators

One of the issues that have been with the serveries architecture is that of cold start latency, where a delay is usually encountered when a function is triggered after a certain period of inactivity. This latency can also affect the system performance, especially if the application involves a time-sensitive nature, such as the payment gateway. In this research, load characteristics have been used to measure could start delays in Azure Function. It was also found that the cold start times were cut in half with the help of the “always on” of Azure, which keeps functions prepared and warmed up, especially useful for heavily used cases. Cold start delays were evident, but more so during low demand to get closer to the always-on option, which can execute the option nearly instantaneously.

Payment gateways aim to provide fast and efficient transaction processing to enable respondents’ satisfaction and avert any service hitches. New aspects of the implementation of the transaction cycle were identified when using the event-based architecture of Azure Functions: By organizing the subsequent steps of the transaction processing cycle with the help of the event-based architecture of the Azure Functions framework, the total time for transaction processing was reduced several times compared with the use of server systems. Azure Functions has the capability to scale on its own in order to handle more traffic, which eliminates the congestion problem during large volumes of transactions. The study showed that this auto-scaling ability enabled more efficient and quick execution of transactions, specifically during specific times, thus improving the performance of the system and serving the customers better. Another important benefit of the work and operation of the payment gateway was the capability to process several transactions at the same time without manual interruption.

Azure Functions come with a pay-as-you-go pricing approach, which means that organizations only get billed for the computing power they consume. On the other hand, the conventional designs involve practising servers even if they are not fully needed in the system. The research established the amount of resources consumed based on one transaction load. It revealed that, generally, Azure Functions was cost-effective, especially when placed in situations of low transaction throughput. Instead of organizations having to incur costs for unused infrastructure, institutions that have incorporated Azure Functions could readily regulate how much of the resource was needed depending on usage and hence minimize operating expenses greatly. Such flexibility coupled with automatic scaling is very effective and efficient in the management of expenses; hence, top performance shall always be achieved.

The experiments with the payment gateways utilizing Azure Functions show that in terms of multiple parameters, there is a great improvement as compared to the traditional server approach. All these enhancements are important for enhancing the efficiency, client focus, and cost structure of contemporary money-related systems.

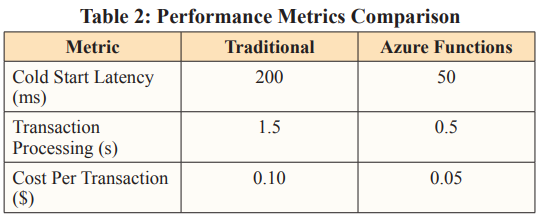

An essential quality to consider with regard to serverless computing is cold start latency, which is just the time that it takes to begin the execution of a function that has been idle. Hence, you do not have cold start kind of problems as servers in traditional server- based systems are always ON, but it does come with its own set of overheads like over-provisioning and utilization. Azure Functions, on the other hand, deals with this problem in its Premium tier, which has the “always-on” capability. This means functions will be pre-warmed, and the cold start latency will be reduced to 50 milliseconds. Conversely, architectures of conventional designs often have something like a 200 millisecond start-up time. This reduction in latency turned out to save every hard-earned millisecond, especially for payment gateways, which require an uninterrupted and quick flow of transactions between the server and the user end.

Figure 5: Performance Metrics Comparison

Another important factor commonly used when measuring payment gateway performance is transaction processing time. The legacy server-based deployments mean that the transaction processing is more time-consuming because it is limited by the resources of the servers and the bottlenecks that may occur. On the other hand, Azure Functions are based on event-driven systems, where all resources are provided on the fly, which makes the use of resources optimal. This kind of elasticity allows Azure functions to process transactions, hence saving time since the processing time is reduced from 1. 5 seconds in the applied traditional systems down to 0.5 seconds. This faster processing time is very useful during times of heavy transaction loads, which makes the users of the system more satisfied due to short waiting time and more cleared transaction rates.

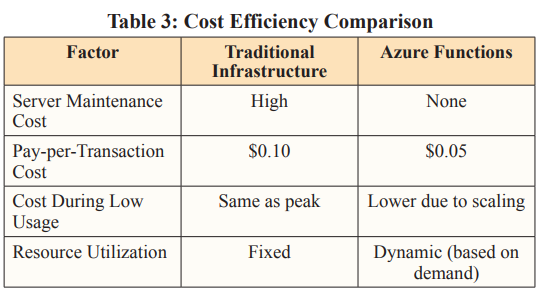

One of the main factors that are important for payment gateways is the cost, as the number of transactions can vary greatly. Previous solutions based on servers imply certain fixed costs linked with the usage of the servers and their capacity. Azure Functions, on the other hand, works on a pay-per-execution basis. This means that businesses are charged per the actual number of executions and resources, leaving them with cheaper transaction means in comparison to a previous $0. 10 to $0. 05. This great cost reduction is useful when dealing with the fluctuations of transaction volumes, which means that one can be able to expand their business without incurring additional costs when they are not needed.

Azure Functions also incorporate state-of-the-art security algorithms to safeguard personal information during storage as well as during data transfer. For data created in Azure SQL Database or other database services such as Cosmos DB, the Azure Functions use AES to traverse a 256-bit key or AES 256. This encryption standard is among the most accredited standards for its prowess in protecting data from unauthorized access. On the go, Transport Layer Security (TLS) guarantees the privacy of the data in the interests of the users and between the payment gateways and the back-end systems. The later practices assist in the protection of most sensitive financial details, such as credit card details and personal identifiers, as required under many data protection statutes.

APIs are the main points of interaction between external systems and the payment infrastructure; thus, APIs need to be secured for payment gateways. API security in Azure Functions is aided by several advanced features such as the following. For example, Azure API Management Gateway has the capability of adding a layer of security by applying some common policies such as rate limiting, IP filtering and OAuth2 token-based authentication. There are specific controls implemented to restrict the frequent requests from the user or from the system, like rate control. IP whitelisting limits access to specific IP addresses that are known and safe, while OAuth2 guarantees centralized and standard means of authentication for API operations. Together, they help to secure the APIs of the payment gateway, thus avoiding unauthorized access or even attacks.

In payment gateways, following standard compliance like PCI DSS is mandatory. Pay and Card protection compliance is made possible through Azure Function integration with Azure Security and Compliance tools. These measures contain compliance, such as the application of encrypted storage, secure API gates, and secure access. Some of the integrated compliance features of Azure Functions are as follows – they help organizations achieve compliance with the PCI DSS, which is essential when dealing with payments. Azure also offers compliance certifications to strengthen these standards for payment processing security.

Restriction of access to the environment of payment systems is another important aspect when addressing the issue of security. Azure Functions for identity and access using Azure Active Directory (AAD). AAD, for example, help in centralizing the identity management service and gives access to the Azure Functions and other Azure services. The integration with AAD enhances the support of multi-factor authentication, which provides an extra layer of protection as the user is required to enter more than the password for him or her to be granted access. This integration makes it possible for only the users and systems that are permitted to access the payment features to do so, thus preventing the occurrence of unauthorized access and, thus, security breaches.

Azure Key Vault is used in the management and protection of an organization’s encryption keys and secrets. Through the utilization of Azure Functions enables a secure means of storing and accessing some of your cryptographic keys and application secrets, including API key connection strings, among others. This integration makes it possible to avoid exposing all sorts of information in code or configuration files, thus reducing the probability of exposing important information. Azure Key Vault’s access control adds another layer of security to it as it enforces policies on who can view or alter such secrets. This adds an additional layer of security to the whole payment gateway system and enhances its general inalterability and security.

Another key benefit of Azure Functions is that the application’s payment system is based on consumption only. Contrary to the typical server-based architectures regarded as standing costs irrespective of their utilization, Azure Functions provide charges based on energetic execution and used resources in the course of the execution. This model does away with the need to pay for dedicated servers that may lie idle for most of the time, especially in organizations which have low sales during certain hours of the day or days of the week. This is particularly advantageous to organizations that subscribe to Azure Functions, which enables the user to pay only on an as-needed basis depending on the usage of computing power; hence, saving costs is possible, especially for applications with fluctuating workloads.

Another drawback of having a traditional payment gateway infrastructure means that there are normally hefty charges that are closely related to server maintenance. Some of these costs include hardware maintenance, power consumption, and the physical space that the systems occupy. Furthermore, it involves creating a provision for servers for peak load; it is expensive; therefore, one pays for what will not be used most of the time. Unlike Azure Functions, users do not need to maintain the server as it is not under the user’s control. The foundation of the app is hosted comprehensively on the Microsoft Azure platform, which performs the responsibilities of scaling, updating, and security. Therefore, they are able to do away with the expensive cost of managing physical servers, which is so common in traditional businesses.

Below, we present conventional infrastructural cost per transaction comparison with the cost in Azure Functions; in a traditional setup, CPT is fixed within a certain level and does not change significantly with changes in the number of the transactions because of fixed server costs and maintenance expenses. I have also never heard of Azure Functions, but it has a slightly lower transaction cost of $0.05 compared to $0.10 in traditional setups. This is realizable by garnering an efficient use of resources and a usage-based price model that adapts to use on its own. Therefore, much. Testing is advantageous to businesses in cutting operating expenses, especially in high-turn environments.

As evident from the above discussion, serverless architecture is highly flexible and can easily meet fluctuating transactions. While such solutions perform satisfactorily during low usage, the traditional infrastructures still carry costs akin to that of the peak periods since they require serving at full capacity. Azure functions can automatically provide up or down resources depending on the number of applications in use at a given time. However, they will be cheaper in periods when there is less utilization. Such scalability helps organizations pay for only the utilities they consume, which forms a flexible budget during the low consumption of utilities.

Priori infrastructure architectures have always had the characteristic of being rigid; that is, allocated resources are pre-planned and established according to the peak load with no reallocation after that. This may result in a waste of resources and, hence, high expenses incurred in the process. On the other hand, Azure Functions take a dynamic resource allocation approach where the resources are requested based on the need at that time. This dynamic approach makes it easier for Azure Functions to manage transaction load that fluctuates from time to time to ensure that the resources used are not wasted, thus minimizing their costs.

Azure Functions are one of the modern approaches to payment gateways in financial organizations since they can easily manage variations in the transaction load. It is important in the financial business, especially when the number of transactions in the business is unpredictable at certain times of the year or certain periods, such as during the holiday season or during business promotions. This can be achieved through Azure Function, enabling resources to be load-balanced in real-time in case payment gateways become unresponsive. This means that there is no need to use manual scaling for resources as would be expected with traditional architectures, hence offering users a smooth experience even under high load.

Speaking of security, Azure Functions leverage a number of the inherent Azure services to address strict compliance standards, like PCI DSS. The protective infrastructure provides confidentiality, availability, integrity, non-repudiation, composite verification procedures, and the ability to combine with other Azure securities, such as the Azure Security Center and the Azure Key Safe. Such tools keep the level of protection in financial institutions at the highest standards, thus preventing the leakage of payment data. These measures are particularly important given the continuously evolving threats that focus on the financial systems. At the same time, the lack of proper security can have an adverse impact on the company’s revenues and reputation.

Economic is yet another advantage that can be associated with the utilization of Azure Functions for payment gateways. This means that the financial institutions will only pay for the resources used during periods of actual transaction processing, in particular, using a serverless, pay-per-use system. It bears mentioning that, unlike conventional architectures for applications where one has to provision servers and ensure these are always available and on standby for use, the Azure Functions adjusts resource requirements depending on usage. It greatly minimizes overhead costs, especially when the number of transactions is low; therefore, it is a financially suitable solution that does not lessen efficiency in using resources.

The use of such serverless structures as Azure Functions in financial institutions also minimizes operational complexity. Conventional integration platforms require the intervention of IT staff to oversee the physical infrastructure, degree of system performance, as well as scaling. In fact, Azure Functions reduce most of this operational overhead for developers to work on the business logic and application rather than managing the environment and hosting the application. If anything, the streamlined process not only gets products out to market faster but also minimizes the retry of error-prone manual infrastructure management for more solid payment solutions. Also, this research features how Azure Functions improve the efficacy of payment gateways in general. Whereas with increased speed and utilization of resources, financial institutions that develop their own applications can promptly change according to the market and the users. This capability of payment gateway software lets it grow with new features, patch bugs, or scale up services in real time. This makes payment gateways to be future-ready in today’s volatile technological environment. This capability correlates well with the trend of advocating for safe, efficient, and effective electronic/ commerce transactions from end users and merchants as they shift to online/mobile purchases.

Therefore, with the aid of Azure Functions, the payment gateway structures could indeed be on for a revolutionary change through making it much more secure, easy to scale, and cheaper to operate. With the increase in demand for digital trading, it becomes easy for financial institutions to prepare for future changes and needs, better performance, and compliance with different regulations and safety standards on payment systems based on this serverless form of computing. As such, Azure Functions deliver a highly flexible and innovative solution for pay systems that offers further advantages in terms of simplicity and the capacity to optimize resources as needed [19-21].