Author(s): Thejas Prasad

In today's globalized business environment, efficient financial management and transparent accounting practices are crucial for organizational success. The Oracle Cloud ERP General Ledger ( GL ) module offers robust tools for managing complex financial transactions, ensuring accurate and compliant intercompany allocations. By examining the practical application of GL allocations, this article highlights the benefits of automated allocation processes, improved financial reporting, and enhanced decision-making capabilities. Additionally, it addresses common challenges and provides best practices for leveraging Oracle Cloud ERP to streamline financial operations across diverse business entities. This study aims to offer valuable insights for financial managers and IT professionals seeking to enhance their enterprise resource planning (ERP) systems and achieve greater financial efficiency within their organizations. This article explores the implementation and optimization of Oracle Cloud ERP General Ledger (GL) allocations, specifically focusing on the allocation of services and markups from a parent company to its subsidiaries.

In the increasingly interconnected world of modern business, organizations with a global footprint often face the challenge of managing financial transactions and allocations across multiple entities. A critical aspect of this management involves the allocation of services and associated markups from a parent company to its subsidiaries. Efficient and accurate allocation processes are essential not only for regulatory compliance but also for maintaining transparency and supporting strategic decision- making.

Oracle Cloud ERP General Ledger (GL) is a powerful tool designed to address these complexities. By leveraging Oracle Cloud ERP's robust capabilities, businesses can automate and streamline their allocation processes, ensuring consistency and accuracy in their financial records. This system is particularly beneficial for managing the intricate web of intercompany allocations, which can otherwise become cumbersome and error-prone.

This article delves into the practical application of Oracle Cloud ERP GL allocations, focusing on how parent companies can effectively distribute service costs and markups to their subsidiaries. It explores the key features and benefits of using Oracle Cloud ERP for these purposes, including enhanced financial reporting, improved compliance, and better resource allocation. Additionally, the article provides insights into common challenges organizations might face and offers best practices for optimizing the allocation process within the Oracle Cloud ERP framework.

By the end of this discussion, financial managers and IT professionals will gain a deeper understanding of how to leverage Oracle Cloud ERP to achieve more efficient financial operations and support the overall strategic goals of their organizations.

Multinational organizations will have entities across different counties and they will be identified as legal entities in the Oracle Cloud ERP application. Fig. 1. Shows the organization structure in ERP system where allocation is to be performed. Allocations across these legal entities will be recorded as intercompany transactions. Large organizations face numerous challenges in the cross-ledger allocation of costs and markups from a main division to subsidiaries. Following as some of the major challenges encountered for performing allocations.

Intercompany transactions can be intricate, involving multiple layers of services, products, and markups. Each transaction requires careful tracking and documentation to ensure that costs are accurately allocated and that all entities involved are properly accounted for. This complexity increases with the number of subsidiaries and the variety of services provided, making it difficult to maintain clarity and accuracy.

Maintaining consistency and standardization across all subsidiaries is crucial for accurate financial reporting. However, variations in local accounting practices, currencies, and financial systems can hinder this standardization. Organizations must develop and enforce uniform policies and procedures to ensure that all entities follow the same allocation methods, which can be a daunting task.

The allocation process can be resource-intensive, requiring significant time and effort from financial and IT staff. Manual processes increase the risk of errors and inefficiencies, diverting resources from more strategic activities. Implementing automated solutions can help, but this often requires substantial investment and ongoing maintenance.

Effective cost allocation relies on seamless integration and management of data from various sources. Organizations often face challenges in consolidating data from different subsidiaries, especially if they use disparate financial systems. Ensuring data accuracy, consistency, and real-time availability is critical for effective allocation but requires a tightly integrated ERP system.

Effective communication and coordination between the parent company and its subsidiaries are essential for smooth cost allocation. Miscommunications or misunderstandings can lead to errors in allocation, affecting financial statements and potentially leading to disputes between entities. Establishing clear lines of communication and regular coordination can mitigate these risks but requires concerted effort and commitment from all parties involved.

While technology can greatly assist in the allocation process, implementing and maintaining the necessary systems can be challenging. Organizations must select appropriate ERP solutions, customize them to meet specific needs, and ensure they integrate seamlessly with existing systems. Additionally, ongoing system updates and cybersecurity measures are vital to protect sensitive financial data.

Figure 1: Organization structure in the Oracle ERP System for Allocations illustration

Approach for Allocating Services Charges and Markups Navigating the complexities of cost allocation for services and markups from a main division to its subsidiaries requires a strategic approach and the right tools. Despite the challenges, leveraging advanced ERP systems like Oracle Cloud ERP can significantly streamline this process, enhance accuracy, and ensure regulatory compliance. By addressing these challenges head-on, organizations can achieve more efficient and transparent financial operations, supporting their overall business objectives.

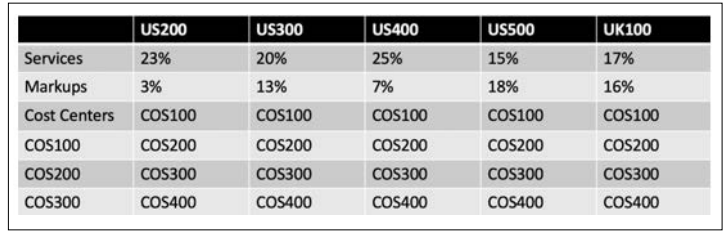

In the company XYZ Inc, on behalf of cost centers or departments (Accounting, Marketing, HR, IT ) the cost is incurred by division US100, which needs to be re-distributed to the four US companies US200, US300, US400, US500 and one UK company UK100 to those specific cost centers or departments. There will be a specific allocation percentage defined for each of the companies. On top of the allocated amounts, division US100 will charge Markup to these divisions. Figure 2. displays the allocation percentages for services and markups for each of the companies.

Figure 2: This table provides the Allocation percentages across divisions and cost centers

In Oracle Cloud ERP, Allocations are designed and configured using the Calculation Manager capability. Allocations are then triggered from the General Ledger module. Fig. 3. shows the allocation engine design at a high level. As a first step, the Point of View (POV) has to be defined, this is the area where the constant attributes are set that forms the framework of the Allocation engine. For real time access the allocation balances are stored in cubes by dimensions. Below are the dimensions used in the allocation engines –

The strategy followed to implement the solution for this specific use case is to create an allocation rule set and within the allocation rule set configure allocation rules for Services and Markups by each Cost Center.

Figure 3: Allocation Engine Design

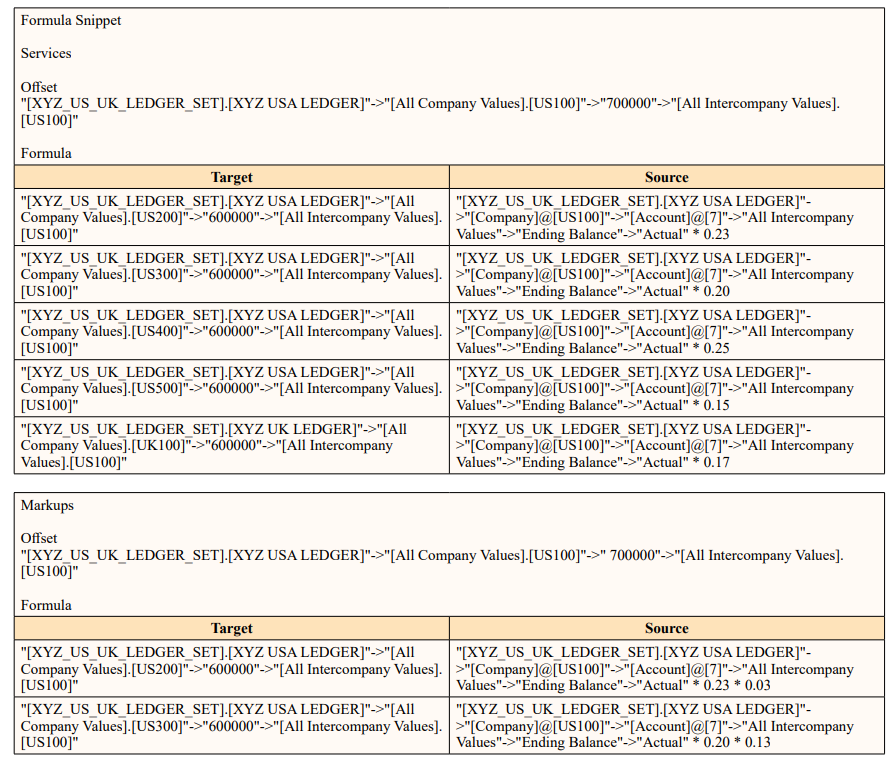

Separate Allocation rules are defined for Services and Markups by each Cost Centers. Let’s take one rule for Service and dive deep. As discussed earlier in the article those dimensions which do not change within a rule are set at the POV level. Since each rule is defined for a Cost Center, value of the cost center ( COS100 ) is set at the POV. Three other critical components within an Allocation rule are Offset account, Source and Target accounts.

Offset account is required to create an entry for balancing the allocation journal. In general this will be the account from where the cost has to be redistributed. Source will be the account string where the cost balance currently exists in the main Division. Target is the Division, Cost Center & Account to which the cost will be allocated. Fig. 4. Shows the sample Offset, Source and Target defined. To generate the actual percentages listed in the Fig. 2. the source is multiplied by the rate, for e.g. the Division US200 needs to be allocated 23% of the total cost, hence the source balance is multiplied by .23 ( "[XYZ_US_UK_LEDGER_SET]. [XYZ USA LEDGER]"->"[Company]@[US100]"->"[Account]@ [7]"->"All Intercompany Values"->"Ending Balance"->"Actual" * 0.23 ). Similarly for calculating the Markups, the Source is multiplied by Services rate 0.23 followed by the Markups rate 0.07, ("[XYZ_US_UK_LEDGER_SET].[XYZ USA LEDGER]"->"[Company]@[US100]"->"[Account]@[6]"->"All Intercompany Values"->"Ending Balance"->"Actual" * 0.23 * 0.03 ).

To generate the Allocation journals, trigger the Generate General

Ledger Allocations. Following are the parameters to be passed:

Once the Generate Allocations job successfully completes, allocation journals will be created in the General Ledger module.

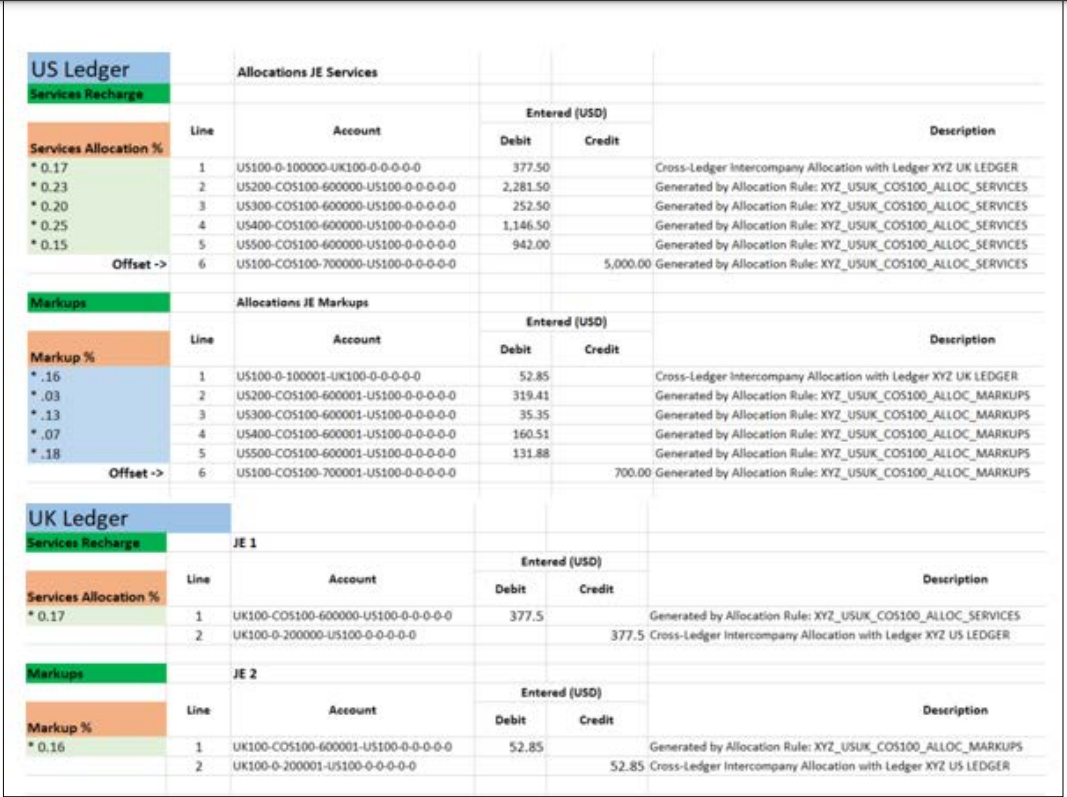

Once the Allocations job is completed as discussed in the section (C), allocation journals will be generated and imported to Oracle General Ledger module. Figure 5. represents a sample allocation journal entry based on the design discussed in this article. Since the allocation is performed cross Ledger, there will journals created in US Ledger and UK Ledger. Intercompany rules configuration is a pre-requisite for this Allocation process. Based on the intercompany rules, the cross ledger intercompany accounting will be generated.

Figure 4: Allocation Formulas sample

This will be the final step of the Allocation process. After posting the journals, based on the intercompany rules configured in the system, Intercompany Journal Lines will be added to the allocation journal to balance the cost transfer from Division US100 to other Divisions (US200, US300, US400, US500, UK100) for the Cost Centers ( COS100, COS200, COS300, COS400) hitting the Intercompany Payables and Receivables Accounts. Same Intercompany rules will be applied for both set of journals created for Services and Markups. As the Journal Posting is completed, it will be available financial reporting.

Figure 5: Allocation Journals created in the General Ledger module

By leveraging Oracle Cloud ERP's robust allocations capabilities, companies can automate complex allocations, reduce manual intervention, and enhance the efficiency of their financial operations. The implementation of a robust cross-ledger allocation solution for distributing the cost of services and markups from a main division to its subsidiaries is a transformative step for modern enterprises. Utilizing advanced ERP systems like Oracle Cloud ERP, organizations can overcome the complexities inherent in intercompany transactions, achieving new levels of accuracy, efficiency, and compliance.

The use case discussed in this article are the process within the Oracle Cloud Enterprise Resource Planning (ERP) application’s General Ledger module and the custom allocation process designed to enable the smooth cross-ledger Intercompany Allocation process.

The implementation of cross ledger allocation of the cost of services and markups from a the main division to its subsidiaries within Oracle Cloud ERP represents a significant advancement in financial management and intercompany alocations. This custom solution discussed in this article streamlines the allocation process, ensuring accuracy, compliance, and transparency across all financial records. By implementing such solutions, businesses can achieve greater transparency, optimize resource allocation, and support sustainable growth. This solution ensures precise and consistent allocation of costs across various ledgers, enhancing the reliability of financial statements and supporting better decision-making processes. By automating these allocations, companies significantly reduce the risk of human error, streamline operations, and allow financial and IT teams to focus on strategic initiatives rather than manual data entry and reconciliation tasks. In conclusion, the adoption of a cross-ledger allocation solution not only improves financial management but also drives overall organizational efficiency and strategic agility [1-4].