Author(s): Reshma Sudra

Digital currencies and coins are methods of computer-generated currency which uses cryptography for safety and operate individually of a dominant authority, like governments and economic institution. They are spread out and usually utilize blockchain technology to note transactions strongly. Cryptocurrencies such as Bitcoins, Ethereum, and some others have grown popularity in the latest eons for their latent to deliver borderless, secure, and fast transactions. Yet, they also arisen with threats like security concerns, regulatory uncertainty, and price volatility. It is vital for operators to conduct detailed research and comprehend the threats included before capitalizing or utilizing cryptocurrencies. Even though cryptocurrencies and coins have grown famous and are being gradually used for countless transactions, it is significant to remind that they still have not passed the traditional banking systems. Traditional banking sectors still perform an important part in the worldwide economic system, offering services like payment processing, savings accounts, and lending. Conversely, the growth of cryptocurrencies has directed to conferences about the possible influence on the financing sector and the necessity for traditional banking systems to acclimate to the varying setting of digital economics. It is important to observe these growths closely to comprehend the evolving association among the crypto-currencies and system of traditional banking. Hence, the current study gives the deep knowledge in the usage of crypto currencies, digital coins and their role in financial sectors that is dominating the traditional banking sector. And analyzed the impact of crypto currencies and digital coins on investors and economy of the nation and also regarding the easy accessibility of finance

Digital currencies are the form of currencies which is obtainable only in automated or digital method. It is as well termed digital cash, electronic currency, electronic cash, and cyber money. These currencies do not have corporal characteristics and are obtainable only in the digital system. Transactions including digital exchanges are finished using processors and electronic wallets linked to the networks or the designated internet. Comparatively, physical exchanges like banknotes and imprinted coins, are perceptible, which means that they have certain physical qualities and features. Transactions including such exchanges are made conceivable only during the time of physical control of these exchanges through their holders [1].

These currencies have value similar to corporal currencies. They could be applied to buy goods and make payment for amenities. They could also find the controlled use between some digital communities like social networks, gambling portals, or gaming sites. These currencies also allow instant dealings which could be flawlessly implemented across boundaries [2]. For example, it is conceivable for an individual situated in the USA to make expenditures in digital cash to a counter-party existing in the Singapore district, delivered when they both are associated with the identical web. These currencies could be consolidated or dispersed [3]. Fiat coinage that exists in corporal method is a consolidated system of invention and circulation through a bank and agencies of government. Protruding crypto currencies, like digital coin and Ethereum, are the main instances of decentralized online currency structures [4].

Bitcoin is a form of digital or crypto currencies and also an intermediate of exchange which occurs entirely online. The cash has been broken into the consciousness of mainstream in the year 2017, as their prices ran up to thousands of US dollars within a single year [5]. More of late, it has gone through the maximum in the years 2020 and 2021, because dealers looked digital currencies in a way to become rich rapidly, before dropping immensely in the year 2022. Digital coin has produced more controversies, from supporters who are saying that it is the prospect of money to those who criticize it as a hypothetical bubble. Bitcoins are issued in the year 2009, while the software supporting the bills was out. Its roots are the little bit shadowy, but a person or group called as Satoshi Takemoto grabs the recognition for launching crypto currencies.

Bitcoin works on a decentralized networking computer or circulated ledger via blockchain expertise, that copes and ways the exchange. The distributed account book such as a large public transaction records taking part in the exchange of currencies [6]. The networked workstations substantiate the transactions through confirming the reliability of the records and the proprietorship of digital coins. They are remunerated with digital coins for their responsibility. This network of decentralization is a vast portion of the Bitcoin appeal and some other digital currencies. Operators could transfer currency to one another, and the banks face the deficiency of managing the currencies and makes those currencies independent. This self-sufficiency refers that the cash, could elude the government interference and banks atleast academically [7].

Bitcoin could operate secretly in most cases. When transactions may be perceptible to some users, the name of the person is not directly tangled with the contract, even if the deal is treated openly. However, experts have become well at following the activities of digital coins, as the Bitcoin ledger dealings is publicly accessible [8]. Though the crypto currency world is progressively escalating and gaining acceptance, traditional banking systems are uncertain to accept the usage of these digital properties. It is to believe that their intrinsic threats outweigh the possible remuneration. However, controlling agencies like the (OCC)- Office of the Comptroller of the Currency are functioning to change the perception of banks of crypto currencies, considering that these possessions can positively lead economic institutions to a completely new innovative and efficient era [9]

.

In recent times, the OCC allotted numerous informative letters describing the entry of traditional banks into the transactions including crypto currencies. This power overlaps with the hope of OCC that extra regulatory supervision would assist banking systems become more relaxed with these alpha numeric possessions. At the earlier times of January month, the OCC proclaimed that nation-wide banks and centralized associations of savings could now utilize public block chain networks and stable currencies to implement payment actions [10]. This unlocks the door for financing systems to have the capability to practice payments much earlier and devoid of the necessity of third-party agencies. Fundamentally, this descriptive letter sets blockchain links in the similar group as Fed Wire, ACH, and SWIFT, driving the pathway for these systems to be a share of the superior banking bionetwork [8].

Banks might be cautious of digital currency, discerning that transactions including these possessions present sensitive threat and need lengthy and luxurious due meticulousness. But crypto currencies could offer numerous welfares to economic institutions and their consumers as they only want to yield the bound [11].

Immense computer miners need more energy to function. Generating electricity is luxurious and contaminates the atmosphere, for what certain critics guess is a project currency with the slight viability. Rendering to the (CBECI) Cambridge Bitcoin Electricity Consumption Index, digital coins will be ranked as the 27th uppermost consumer of electrical energy, if it remained a nation as of April month in the year 2023. It will be ranked 70th because of its emissions of greenhouse gases. Those are vast amounts for hardly utilized digital currencies. Due to its nature, the amount of coins is inadequate, and that postures a severe threat on utilizing currencies like Bitcoin. Effectively, these boundaries do not permit the supply of money to be improved that is treasurable when a financial management experiences downturn. If applied all over an economy, digital coins can produce critical deflationary spirals that are very classic when markets loped on the standard of gold. Actually, this distress is a main reason for the elimination of the gold standard.

A challenging condition arises while customers and others reserve currency in the period of tough financial times. When cash does not flow, it decelerates frugality. Without a fundamental authority like a bank to strengthen frugality or bid recognition, the economy can change into a spiral of deflation. So customers do not invest because goods would be low-priced tomorrow, generating a spiral of deflation. With a static amount of units, digital coins do not deliver the suppleness required to achieve a system-wide exchange. Administrations have been moderately slow to respond to the introduction of crypto currencies, but several have now awakened up and are started to study the ways to adjust it. Certain countries like China, have expelled it completely, when others are enduring to do the same. Still some other countries like the USA, are inspecting about the effective ways of regulating crypto currencies.

Joe Biden, the President of the USA has asked the central government to study about digital currencies, the threats to economic strength and national safety, the ecological influence and even the formation of digital dollars. But even after these investigations, the US regulations stay unclear. The change to a vibrant controlling agenda is energetic in grace of the great profile blow-ups of Terra US dollars, a stable coined digital currency that is intended to grasp a fixed charge. The formation of digital dollars with the constancy of tangible dollars might make isolated digital currencies less adorable. Their digital attribution creates crypto currencies liable to hacking. Hackers could take crypto currencies from virtual wallets or alter the etiquette for crypto currencies, turning them unfeasible.

As the abundant cases of drudges in digital currencies have demonstrated, obtaining digital structures and bills is a work- in-progress. Crypto currencies are not used generally as a mode of payment through retailers and some other initiatives. Due to this, applying them for tedious transactions might be stimulating. Even though crypto currencies have grown popularly, there are still inadequate functionalities in routine transactions in several locations. On a network of digital currencies, transactions are irretrievable. This refers that after a complete transaction, it could not be uncompleted. In situations while a fault or fraudulent has taken part, this might be a drawback. This is an incredible drawback for those who are fresh to the space of digital currencies, as there is a considerable learning curvature. Because of the unavailability of a vital oversight region for numerous digital exchanges, new operators could not merely drive to their residential branch to accept assistance for numerous digital currencies.

Depending upon the characteristics of crypto currencies, it is flawless that they all have the latent to convert the economic and budgetary structure, as signified through the banking division. Though knowing the precise value and benefits, crypto currencies and digital coins accumulating the finance sector is indispensable. Basically, the investigation of the benefits of crypto currencies and digital coins on the traditional banking system would offer proper rejoinders like why the traditional banking sectors need to be shifted in the direction of crypto currencies. At this juncture, there are some prominent remuneration of bitcoins and crypto currencies in the financing sector.

The paper is ordered in the subsequent flow in which Section 1 provides the elaborated overview concerning the crypto currencies and digital coins in the traditional banking sector. In section 2, prevalent research works associated to present study would be studied. The present study’s emergence, cash flows and influencing factors would be clarified in the section 3. In section 4, the discussion would be made through comparing our study with other studies. Lastly, in section 5, the short-lived conclusion concerning the present study would be deliberated along with restriction and upcoming commendations of study.

The existing study aims to state the methods on how Bitcoin dares the traditional banking structure and to evaluate the future scheduling system for traditional banks to contend with digital currencies. Bitcoins are the cost-effective stage for the shareholders, but a minute risk for the customary financiers and the administrations [12]. Therefore, the approaches and concepts of folks from diverse experience have been considered and examined for existing research. The existing study conducted surveys between persons who are accustomed with both the Bitcoins and the traditional banking system and attempted to catch out the answers. The existing study applied the qualitative research method where semi-structured interviews were conducted. The statistics has been examined depending upon the perspective of interviewees. While organizing this paper the writers inspected previous researches of this domain. Additionally, there are many scopes for upcoming studies regarding the issue of bitcoins and also the occasions and risks for some other banks. The researchers elucidated the proposals for future researches that may be the plans for traditional banks. Conversely, this crypto currency has certain unavoidable threats and the uncertain image that frequently used to support illegal doings.

The existing study (Dupuis & Gleason) aims to define the chances and boundaries of digital currencies as a device for cash laundering over six presently accessible interchange mechanisms. The existing study links the supervisory dialectic pattern to identify the consumer and anti-money legalizing evasion skills, highpoint six strategies to filter capitals with virtual properties and examine latent law implementation and regulatory substitutes applied to decrease the occurrence of money legalizing with bitcoins [13]. The method applied is the study of important recent actions and the obtainability of fintech crime-fighting apparatuses and a review of literature concentrating on the tender of the supervisory conflict to novelties in prevailing crypto-asset marketplaces which make them convincing to currency launderers. The existing study examines the illegal usage of digital currency over Kane’s supervisory dialectic pattern, find a number of ways for crypto to the official sanction exchange which are still accessible for those looking for laundering money via bitcoins, review lately closed doors and create recommendations concerning the parameter of crypto- related marketplaces which might help in building them less necessary for criminals probably.

Commercial science has grown over numerous decades in the direction of greater importance on modes of payment. Electronic payments (e-Payment) riot starts with electronic-cash, electronic- cheques and electronic-Portfolio finishing up. With digital currencies in common and with digital coins in specific, initiated in the previous decade, is probable to take additional and deep effect on frugalities and economic researches. With digital currencies, folks no longer have the need to go to traditional financing sectors if they want bankrolling. Peer-to-peer nets, involving those depend upon digital currencies are turning more general and those who may be twisted away through traditional finance sectors have alternative ways around funding. Thus, economists made the practice of newly accessible expertise and new fiscal data or secluded data sector which are frequently gained over collaborations with isolated, organisations, giving growth to new chances and encounters. The existing study (Salah Eldin Fahmy) targets at learning the Crypto Currency effect on frugalities. The major findings of the prevailing study is to know about the Crypto Currencies’ future, especially Bitcoins [14]. The foremost hypothesis is, parallel to numerous countries, the economy of Egypt would hook up with other nations and digital currencies would be somehow assimilating with traditional methods of payment.

The existing study (A. Gulled & J. Hossain) aims to state the methods on how Bitcoin dares the traditional banking structure and to evaluate the future scheduling system for traditional banks to contend with digital currencies [15]. Bitcoins are the cost- effective stage for the shareholders, but a minute risk for the customary financiers and the administrations. Therefore, the approaches and concepts of folks from diverse experience have been considered and examined for the existing research. The existing study conducted surveys between the persons who are accustomed with both the Bitcoins and traditional banking system and attempted to catch out the answers. The existing study applied qualitative research method where semi-structured interviews were conducted. The statistics has been examined depending upon the perspective of interviewees. While organizing this paper the writers inspected previous researches of this domain. Additionally, there are many scopes for upcoming studies regarding the issue of bitcoins and also the occasions and risks for some other banks. The researchers elucidated the proposals for future researches that may be the plans for the traditional banks. Conversely, this crypto currencies has certain unavoidable threats and the uncertain image that frequently used to support illegal doings. Because of the unavailability of the governing authorities and involvement of central bank, it tolerates hesitation for the stockholders of Bitcoins. The existing study helps to excavate the acquaintance and established the explanation how Bitcoin disturbs the traditional banking system.

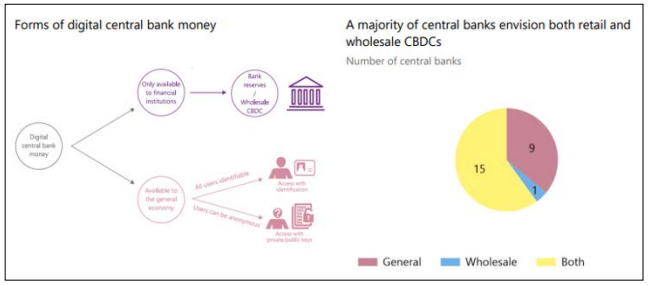

The circulation of a (CBDC) - Central Bank Digital Currencies might bring the chance to develop expenses if its virtual benefits over conservative money are used. As a crypto currency, a CBDC could aid the economic system to save up with the cardinal wave perceived in various divisions, simplifying digital commerce and the ingestion of online goods like music, art, and some others. The CBDC issuance could also have adverse influences on the economic system. Depending on the CBDC type, Central Banks aim to concern. There are possible threats not only for the financing sector and economic constancy but also for homes and trades. The existing study (Baptista) objects to comprehend the effect where the CBDC issuance will have on the European zone [16]. It aims to identify which designs of CBDC can reduce the negative influences on the financing sector and economic stability; and also regarding the value of financing sectors in the Digital European money. The methodology applied for collecting empirical data was over interviews, gathering testimonies from experts in the financing division, whose information and work areas might shed certain light on the influence of the Digital Euro issuance. The existing research concluded that the CBDC introduction in the European zone which is also known as Digital Euro, can harmfully distress the financing division if not intended inside the mind. Based on the meetings, it was concluded that the CBDC introduction cannot lead only to elimination of intermediaries in disbursements but also in the times of predicament, to bank turns where consumers with bank payments will transform these into the Central Bank deposits. After gathering the views of banking experts, the prevailing study determined that the CBDC type which will diminish the negative influences on the financing sector and financial stability will be a type of CBDC with consolidated style, account-based access technique, an inland opportunity, unintended control through the Central Bank, thus upholding the prevailing Two-Tier Structure.

The existing study (Partanen) aims to identify the feasibility of digital currency in association to the retort of economic organizations and governments [17]. The existing study collects the responses from US, EU, South Korea, China, and Switzerland offers adequate information because of their position as leading areas in speculation and day-to-day trading of digital currencies. Statistics of historical rate, value, and some other data would show the result that the huge shareholders have had on the digital currency marketplaces. The analysis delivered would use the PESTLE and SWOT method with an intention of providing a well-rounded end. The rejoinder that administrations and economic institutions have made indication that digital currencies want to be managed and measured through authorities because of their environment as a nameless peer-to-peer net way of generating transactions. The existing study concluded that digital currencies are feasible nowadays as a home of speculation when categorized as a service, commodity, or asset. They would stay viable if administrations have structured it rendering to their guiding principles. The findings demonstrated that crypto currencies could not encounter the present legal proposals and therefore could not turn out to be new standard for exchanges. Finally, the existing study found that digital currencies would have to allow central facets of their essential identity like obscurity to be applied into legal agenda.

The renovation of the financial structure has become progressively fast in recent years. Firstly, it doomed more official variations in currency. But with the growth of expertise, the attention was on accessibility and efficacy, so the money digitization has also arisen [18]. The expertise depends upon a digital signatures’ chain. This is referred as blockchain that is essentially a digital record which lists the preceding proprietors and their related transaction events over signatures [19]. The technology of Blockchain was primarily used through designers of cryptocurrencies to permit the interchange of economic possessions without the participation of a 3rd party (Nakamoto, 2008). These cryptocurrencies unlocked a new epoch in money transformation. Though, this was headed through a number of unsuccessful attempts, like Bit gold, Hash cash, or DigiCash [16]. Maulid (2015) said that a worthy blind sign has four significant features. They are

The spirit of a blind sign is to reserve the obscurity of users which has been employed in the digital currencies system. A blind sign eradicates two important difficulties at a single time. While money payments function secretly, their drawback is that stretch free aperture to corruption. In contrast, crypto currencies which functions without a blind sign have the latent to control misconduct, but the security of personal information is pressed into the context. Though, the early simulated currencies contain numerous faults [20].

Nowadays, Bitcoins are the well-known cryptocurrencies that has not been widely used yet as a payment mode but somewhat a hazardous investment form because of sharp variation of the price of market which applies a blockchain technology to confirm transactions, validate them in sequential phase and decode them. This is the way of the evolution of blocks that creates the blockchain. These are functioned through a peer-to-peer system of computers which have nodules on them. Every single nodes store a whole general ledger copy. The structure is an open source, creating the network available to everybody, without the necessity for 3rd party to convey out transactions among two parties. Consequently, cryptocurrencies are regionalized through their coordination [21].

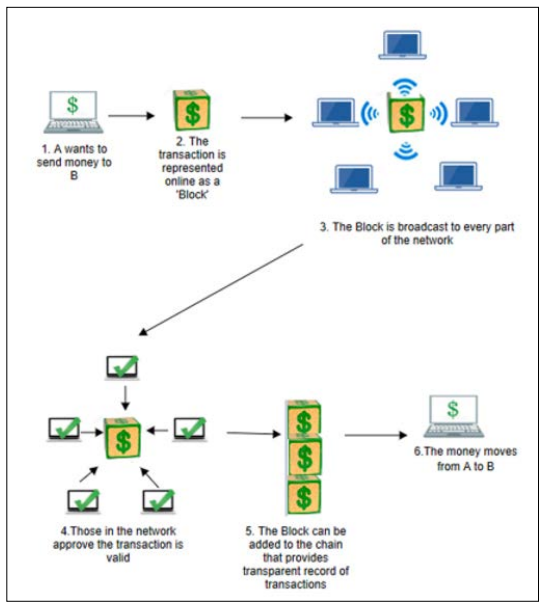

Figure 1: Working of Digital Currencies Through Blockchain [22]

In case of crypto-currencies and transactions, their related information are accessible in an alphanumeric ledger, systematized into lumps. These blocks are linked to each one, real and time- stamped through the nodules in the peer-to-peer network. This endorsement declares that no double outlay arises. The legitimate data blocks associated will form a sequence. This is referred as blockchain [23].

The alternative and recognition of cryptocurrencies in the marketplace have prompted associated negotiations on the opportunity of banks delivering their cryptocurrencies and the upshot insinuation of the exchanges on the whole economic and fleeting systems. The knowledge of banks rising out their cryptocurrencies is pertinent to the marketplace seeing the increase of technical progression, technological novelties, and the rise of digital currencies which intensify struggle in the economic space. Additionally, the benefits could also be related with the accessibility of crypto currencies in today’s marketplaces and their significance between individuals.

Figure 2: Digital money in economic divisions [24] Supremely, the factors leading the banking division to crypto currencies are as follows:

The serious manifestations of cash virtualization is the tendency towards decreasing the cash usage or cash parallels in transactions. Though the tendency is general, it varies from nation to nation. Rendering to Khianonarang and Humphrey, the share of currency in cash-like connections as dignified through withdrawals and transactions of cash through other payment modes like electronic- cash and payments on card has considerably decreased in numerous republics across the globe. Comparatively, the share of money transactions in nations has dropped from 49 percentage in the year 2006 to 29 percentage in the year 2016. The failure in the significance of money or fiat exchanges in dealings is partly determined through the ease and efficiency on gains of digital transactions. Other negotiations involved on limiting, eliminating, or phasing out the usage of real currency to hold prohibited and unlawful economic activities and shortening the zero bound on policy rates of interest. While this can be accomplished through involving digital currencies in the financing segment. The move can be attained through decreasing costs related with digital modes of payment and commercial bank deposits. Nearly, crypto currencies reasonably block the invalidity of actual currencies despite eliminating essential necessities like the status of legal tender. Central and profitmaking banks will reap important benefits from them rather than the actual currencies.

The growing use of internet supported through the development of computing power between economic customers has contrived the whole economy, particularly economic systems. In previous times, there has been an important growth in the amount of digital suppliers and innovative expertise in the economic and field of payments. In addition, worldwide tech businesses are setting an original pace aligned on giving economic services in many ways like online marketplaces, mobile technologies, and social media. As the supervisory groups of the financing division, Central banks are intent with the benefits resulting from the technology of Blockchain and digital currencies. The financing sector is conscious of the regionalized ledgers and condensed threats associated with most of the digital currencies. Grounded on these influences, banks are transforming into the notion of evolving digital currencies of central bank like the Fed and RS coins. Mainly, these digital currencies are destined to work confidentially but would have augmented transparency, sovereignty, and accountability as they are functioned and approved through central banks. So, the model would be remarkable for the users of private marketplace and produce additional pay for the finance sector [25].

From a wider perspective, numerous distresses have been elevated about the special effects of cryptocurrencies on economic structures and the finance sector in common. Inconsistently, crypto currencies permit critical economic assets of the finance sector, comprising safety and fluidity but can also source uncertainties on economic intermediaries and global fiscal systems.

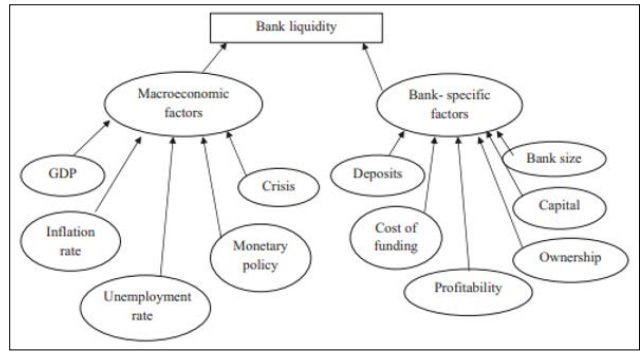

Figure 3: Factors Influencing Banking Systems [26]

The influence of crypto currencies on the financing sector is delineated below:

Digital coins open up economic activities and choices to operators in the marketplace with benefits like condensed operating charges and easy availability of facilities. Though these are the gains to the customers of economic amenities, they might affect economic intermediaries, mainly commercial banking sectors. For example, digital currencies might attract important transactions of payment away from profitable banks. Likewise, profitable banks and some other economic intermediaries will miss payment-related revenue. Correspondingly, the currencies might potentially decrease the deposits of commercial bank, particularly where folks could store extensive cryptocurrencies in some other economic destinations. The economic service disintermediation threat rely on the designated features of digital currencies. If crypto currencies and their stages could not relate with users due to the limitless capability, economic intermediaries, predominantly commercial banks, pace in to deliver front-end facilities and cash-related set-ups [27].

Particularly, digital currencies rise globalization and virtual business occasions through initiating the efficacy and suitability of economic transactions and expenses across nations. Though, the unproductive plan of digital currencies might trigger finance and monetary contests to the country. For example, if a digital currency is utilized as a speculation, its welfares can be decreased to threats that amplify financial shock. Due to the liquidity of digital currency, numerous foreign depositors will use it away from its capability to reply to a financial shock. The prevalent adoption of crypto currencies through other distant central banks will create the European economy very delicate to financial shocks [28].

The threat of digital currencies on economic intermediaries and global economic structures is more distinct in period of economic crisis. Digital currencies can possibly be held in huge volumes with no charge. Because of their liquidness, digital currencies will hasten more alphanumeric runs from profitable banks in crisis times. Investors would decrease their credits in profitable banks and intensify holding digital cash. The letdown of central financing sectors to switch the invasion and processes of digital currencies will accelerate the influence of economic conditions on the frugality and cause severe compensations beyond estimation [29].

In their part as operatives and supervisors of the finance sector, banks are accountable for safeguarding pertinent laws and guidelines. Digital currencies supervisory agendas in the European marketplace might impact the acceptance of crypto currencies through the finance sector. Despite the rising fame of digital currencies, particularly cryptocurrencies, numerous countries have established a negative approach. For example, in Indonesia, Vietnam, and China, crypto-currencies have been governed out as a substitute payment or allocation approaches for fiat cash. Even though the EU has not barred crypto-currencies as a method of payment, it supported for defined controlling policies which rule entry and exit from the marketplace. The lacking laws and guidelines on cryptocurrencies have imperfect possibility of completely accepting digital currencies in the finance sector. The starter of digital currencies like cryptocurrencies in finance sectors would require control of central banks, unlike the standard of confidentially run digital currencies. Though the devolution of digital currencies permits speedy and actual numeric transactions, it extremely disclosures transactions to fake and unlawful networks which cannot be reinforced through the finance sector [30]. In such case, most of the central finance sectors in the region of Europe are accepting monetary virtualization over the framework on digital currencies of the bank [25].

Indeed, Blockchain technologies, digital banking and Fintech innovations could be calculated between the instances of digital currencies and trade. The existing study (Machkour & Abriane) examined the effect of the process of digitalization on the economic division. Similarly, business actions have altered with the occurrence of Commerce 4.0, the development of economic marketplaces in Morocco and everywhere the globe and new technologies of upcoming generation in the arena of finance. Likewise, the current study gives the deep knowledge on the usage of crypto currencies and digital coins in financial sectors and also contemplates about the role of digital currencies that is dominating the traditional banking sector [31].

The existing study (Dell'Erba & Pol'y) examines the main characteristics of stablecoins, recognizes the diverse kinds of stablecoins, and contemplates the role of stablecoins in crypto- economics and their latent to transform dispersed ledger technology [32]. Also, the existing research forms on the difficulties distressing stablecoins concentrating particularly on the seeming contradiction in applying a completely decentralized structure that is depending upon a chief validator; the widespread opacity of auditing actions; struggles of interest developing from relationship of stablecoins with crypto currencies; and their part in the latest Bitcoin bubble. Similarly, the current study analyzed the impact of crypto currencies and digital coins on investors and economy of the nation.

The existing paper (Partanen) finds out the feasibility of crypto- currencies that are in association to the rejoinder of governments and banks [17]. The retort of governments all over the globe has been diverse, but economic institutions like huge banking sectors have been hesitant to co-occur with these fresh exchanges. Cryptocurrency is a risk to huge banks like investment sectors that dares their own survival due to the elimination of intermediaries. All administrations conversed in the prevailing study have permitted their countries to do commerce and own digital currencies, but also have constricted the grasp in changing grades as a retort to its instability. Similarly, the current study identified the challenges faced through banking systems because of the occurrence of crypto currencies.

The preceding study (Dupuis & Gleason) describes the occasions and boundaries of digital currencies as an instrument for laundering currencies over six presently accessible interchange mechanisms [13]. The existing study links the supervisory dialectic pattern to identify the consumer and anti-money legalizing evasion skills, highpoint six strategies to filter capitals with virtual properties and examine latent law implementation and regulatory substitutes applied to decrease the occurrence of money legalizing with bitcoins. Likewise, the present study also recommended various crypto currencies and digital coins for easy accessibility of finance.

Every research has certain drawbacks. Likewise, the current study also have some constraints. The foremost limitation of the research is that there is no prime and secondary sources for performing analysis section. Hence, the results might lack in generalizability. However, the information regarding crypto currencies and digital coins overtaking the traditional banking sector can be helpful to improve the awareness among folks and also the economy.

Digital currencies denote a natural development which is a retort to renovation not only in inadequacy and revolutions but also in the protection of the part of central and profitable banks to deliver safe and protected transacting means and payment modes. Likewise, digital currencies will significantly influence various zones of the financing sector. These influences can involve disturbing the existing monetary, financial, business systems and the occurrence of new financial and social connections or associations. All over history, the security of economic innovations has demonstrated the crucial element of maintaining public assurance in cash, specifically, inside the State. Hence, the important goal of crypto currencies is to slowdown a balance among dominance and to confirm the economic systems endure stable and effective.

Management and regulation close to digital properties is scarce, leaving numerous economic institutions cautious of implementation. Concerns adjoining the safety and strength of digital currencies also embrace banks back from inflowing this space. Instead of be terrified of the threats of this expertise, banks must be observing forward to its possible welfares. There is a massive latent for financial development. So, it is not good to take out those benefits as there is a probability for criminal activities. As an alternative, it is required to offer a complete guidance to aid banks modernize. Financial institutions must also change from considering crypto currencies as an opponent to that of a significant other. Banks could really perform an important part in the industry of cryptocurrencies, adding some of the much required assertion and safety to the generally unregulated atmosphere. Accepting crypto currencies and digital coins overall could rationalize progressions and take finance sector into the upcoming generation of efficacy and improvement.

Hence, the present research gives the deep knowledge on the usage of crypto currencies and digital coins in financial sectors and also contemplates about the role of digital currencies that is dominating the traditional banking sector. And analyzed the impact of crypto currencies and digital coins on investors and economy of the nation. The current study identified the challenges faced through banking systems because of the occurrence of crypto currencies and also recommended various crypto currencies and digital coins for easy accessibility of finance.