Author(s): Abhishek Shende

This research paper explores the evolving landscape of identity assurance in the U.S. mortgage industry, focusing on the integration of federated identity management and digital authentication technologies. It addresses the challenges posed by digital disruption, such as deepfake threats and privacy concerns, and examines the application of international standards and practices in enhancing identity assurance. Drawing on insights from various frameworks including NIST, Kantara, and OIDC, the study proposes a multi-dimensional approach to strengthen digital trust in mortgage transactions. This approach balances technological advancements with regulatory compliance, offering practical solutions for secure and efficient identity verification in the mortgage sector. The paper serves as a crucial guide for professionals navigating the complexities of identity assurance in an increasingly digitized financial landscape.

The mortgage industry, pivotal in the U.S. economy, is experiencing a paradigm shift with the advent of digitalization. Key to this transformation is the assurance of digital identities, critical for the integrity and security of online mortgage transactions [1]. The implementation of federated identity management and digital authentication technologies has become crucial, presenting both challenges and opportunities in this sector [2,3].

Digital identity assurance is a multifaceted challenge, encompassing technology, regulation, and user expectations. The industry faces threats from advanced digital disruptions like deepfakes and privacy breaches, necessitating robust identity verification solutions [4,5]. This paper investigates how identity assurance frameworks, such as those by NIST, the Kantara Initiative, and OIDC, can be tailored to meet the mortgage industry's specific needs [5-7].

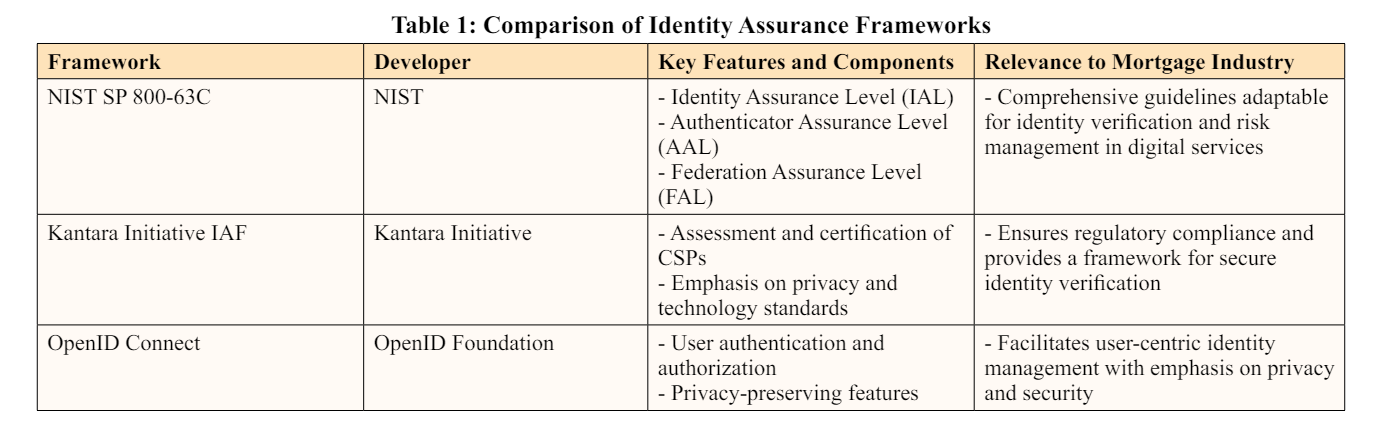

A key challenge in the mortgage sector is ensuring accurate digital identity verification. This paper will discuss these challenges, focusing on the risks associated with digital forgeries and the need for privacy in identity management systems [5]. To illustrate this, we will include a comparison of various identity assurance frameworks, highlighting their applicability to the mortgage industry in Table 1.

Case studies in financial services provide practical insights into the application of these technologies. We will explore real-world examples from U.S. banks and international electronic notarization standards, offering a comprehensive view of theoretical concepts applied in practice within the industry [3,4]

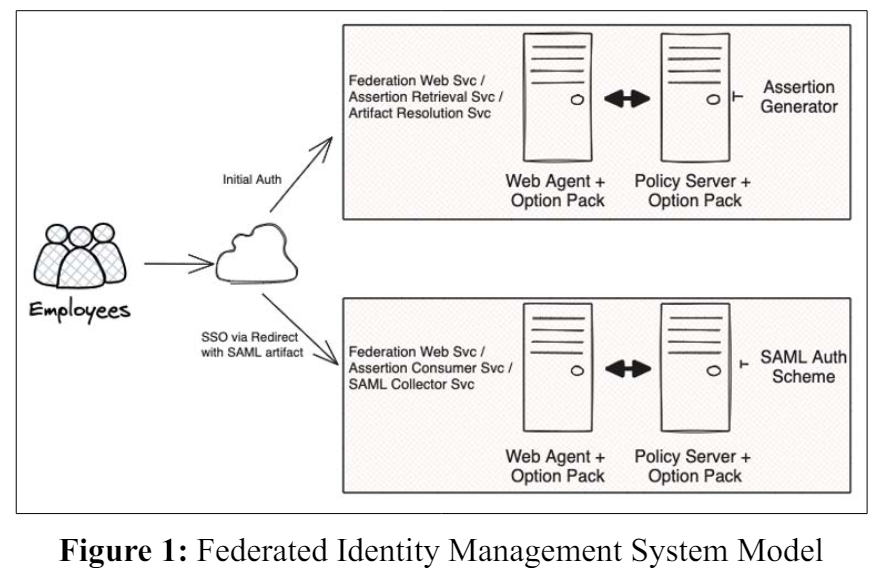

To wrap up the introduction, this research aims to offer a holistic perspective on identity assurance in the mortgage industry. It seeks to bridge technological innovation with regulatory compliance and industry best practices, aiming to enhance digital trust in mortgage transactions. The integration of federated identity management systems in this context is crucial, as depicted in Figure 1, which will be discussed in detail later in the paper.

In the evolving landscape of the U.S. mortgage industry, the significance of robust identity assurance frameworks cannot be overstated. These frameworks are instrumental in safeguarding digital transactions against fraud and ensuring adherence to regulatory standards. This section reviews three major frameworks: NIST SP 800-63-3, Kantara Initiative Identity Assurance Framework, and OpenID Connect (OIDC), each offering distinct methodologies for digital identity verification and management, crucial for the mortgage industry's integrity and efficiency

The NIST SP 800-63-3 framework presents a comprehensive set of guidelines for digital identity services, particularly in federal contexts. It comprises three main components: Identity Assurance Level (IAL), Authenticator Assurance Level (AAL), and Federation Assurance Level (FAL). These components collectively address the intricacies of identity proofing, authentication, and the strength of federated assertions. The framework's multifaceted approach, combining flexibility with a strong focus on privacy and security, renders it highly applicable to the mortgage industry, which demands rigorous identity verification mechanisms [6].

The Kantara Initiative's Identity Assurance Framework standardizes the assessment and certification of Credential Service Providers (CSPs). Emphasizing technology and privacy standards, it ensures that CSPs maintain high levels of identity verification and management. This framework resonates with the mortgage industry's needs due to its alignment with federal standards and emphasis on regulatory compliance. The IAF aids in risk mitigation related to digital identity fraud and data breaches, underlining its significance in the mortgage sector [7].

Developed by the OpenID Foundation, OIDC is a decentralized authentication protocol focusing on user authentication and authorization, with a strong emphasis on privacy-preserving features. OIDC's approach to facilitating user-centric identity management, while safeguarding privacy and security, aligns well with the mortgage industry's requirements for consumer data protection. It provides an efficient and secure method for managing digital identities, simplifying the authentication process without compromising security [8].

NIST SP 800-63-3, Kantara Initiative IAF, and OIDC each offer unique benefits and cater to specific demands within the mortgage industry. NIST SP 800-63-3's risk-based approach is suitable for a variety of digital services. Kantara Initiative's focus on CSP certification ensures high standards of identity management. OIDC's decentralized model addresses contemporary digital identity challenges. Integrating these frameworks, the mortgage industry can enhance its digital trust and security, contributing to a more secure and efficient financial ecosystem.

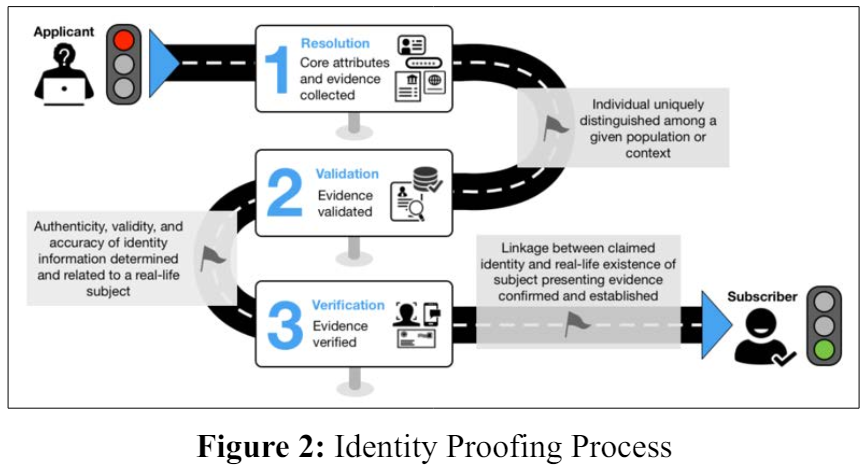

The mortgage industry's transition to digital platforms has intensified the challenges of deepfake technology and privacy concerns. Deepfakes, using AI to create convincing forgeries, pose a significant threat to identity verification, potentially leading to fraud [5]. These advanced digital manipulations challenge the traditional methods of identity verification, necessitating the development of new detection technologies. As depicted in Figure 2, the identity proofing process must evolve to address these sophisticated threats.

Privacy concerns compound these challenges. As digital data accumulation increases, protecting consumer information against unauthorized access and ensuring compliance with privacy laws like GDPR and CCPA becomes critical [7,6]. The industry must strike a balance between rigorous identity verification and the protection of personal data. Figure 2 illustrates the complexities involved in this process, highlighting the need for advanced solutions in identity proofing that consider both security and privacy.

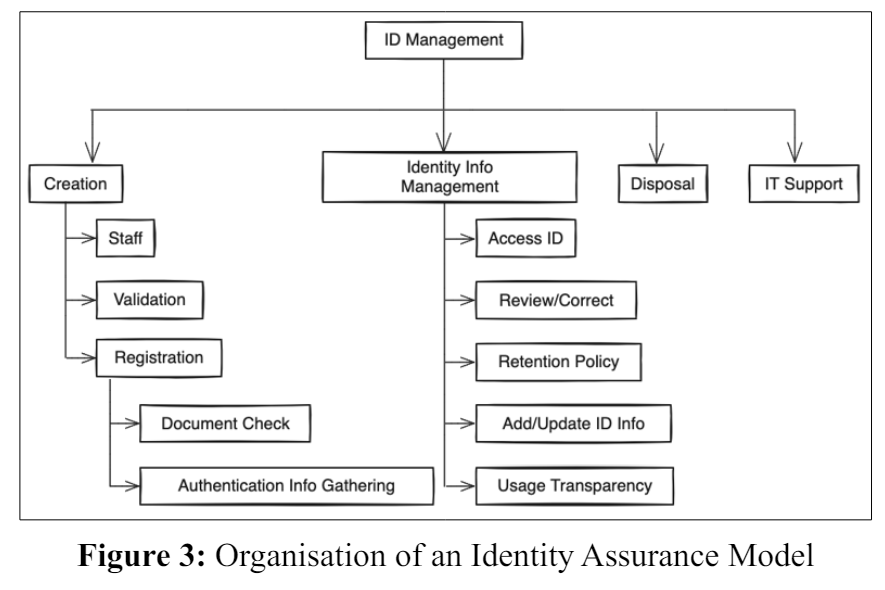

Federated Identity Management (FIM) in financial services, including the mortgage sector, offers a more streamlined approach to identity verification but also brings a unique set of challenges [3,9]. As shown in Figure 3, FIM systems enable various organizations to share identity credentials. This not only enhances the user experience by reducing redundant verification processes but also introduces complexities in maintaining the security and integrity of shared identity information across different systems.

Ensuring consistent application of assurance levels and safeguarding against unauthorized access are key concerns in the implementation of FIM within the mortgage sector. The organizational structure and relationships depicted in Figure 3 highlight the interconnected nature of these systems and the importance of a coordinated approach to managing them.

Moreover, the mortgage industry faces the pressing need to address deepfake threats and privacy concerns, as part of the broader challenge of secure digital identity verification. Advanced technologies for deepfake detection, coupled with stringent privacy controls, are essential. The strategic implementation of FIM, as illustrated in Figure 3, can significantly contribute to mitigating these issues. Overcoming these challenges will enable the mortgage industry to strengthen its digital trust and security, ensuring alignment with regulatory standards and enhancing the overall efficiency of financial transactions.

In the domain of identity assurance and digital verification, realworld applications and case studies provide invaluable insights. Particularly in the financial sector, where security and compliance are paramount, examining practical implementations offers guidance and lessons that can be applied to similar challenges in the mortgage industry. This section focuses on two pertinent case studies: the implementation of Federated Identity Management in a U.S. bank, and the exploration of international e-identity standards for notarization. These case studies not only highlight the complexities involved in adopting new technologies and standards but also demonstrate the potential benefits and improvements they can bring to identity assurance processes in financial services.

The implementation of Federated Identity Management (FIM) in a U.S. bank, as detailed in the case study by Gupta and Sharman, provides valuable insights into the practical applications of identity assurance in the financial sector [3]. The case study explores the challenges and solutions encountered in the integration of FIM using Security Assertion Markup Language (SAML). This system was designed to enhance security and access management within the bank. Key challenges included interoperability issues, ensuring user privacy, and managing the complexity of federated identity systems. The successful implementation of FIM in this bank demonstrated the potential for improved efficiency and security in identity management, making it a relevant example for the mortgage industry as it navigates similar challenges.

Reiniger’s work on the proposed international e-identity assurance standard for electronic notarization sheds light on the global perspective of identity verification [2]. This case study emphasizes the need for a uniform approach to managing notaries’ electronic identity credentials and signatures, ensuring the legal acceptability of electronically notarized documents across borders. The case discusses the implications of these standards for international transactions, highlighting their relevance for the mortgage industry, which often involves complex documentation and verification processes. The study underscores the importance of adopting international standards for e-identity in notarization, which could significantly streamline and secure the mortgage processing pipeline.

These case studies illustrate the practical applications and challenges of implementing advanced identity assurance measures in financial services. They offer valuable lessons and frameworks that can be adapted to the mortgage industry, highlighting the importance of both technological innovation and adherence to international standards in improving the security and efficiency of identity verification processes.

The evolving landscape of identity assurance in the mortgage industry demands a nuanced approach that integrates technological advancements with regulatory compliance. This section delves into the strategies and best practices that can guide industry stakeholders in achieving this balance. By exploring how technological innovations can be aligned with legal and regulatory frameworks, this section provides a roadmap for enhancing identity verification processes while adhering to necessary standards. It underscores the importance of strategic planning and thoughtful implementation in the rapidly changing digital environment of the mortgage industry.

In an era marked by rapid technological evolution, the mortgage industry faces the dual challenge of integrating cutting-edge identity assurance technologies while remaining compliant with an increasingly complex regulatory landscape. This balancing act requires a comprehensive understanding of both technological capabilities and the legal frameworks that govern their use.

Technological advancements, such as biometric authentication, blockchain-based identity verification, and advanced cryptography, offer enhanced security and efficiency in identity verification processes [4,8]. However, their implementation must be carefully evaluated against regulatory requirements such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), which mandate strict standards for data privacy and consumer rights [7,6].

A best practice in this regard is the adoption of a privacy-bydesign approach, which integrates privacy considerations into the development and operation of new technologies. This approach not only ensures compliance with privacy laws but also enhances consumer trust in the mortgage process. Additionally, regular audits and compliance checks are essential to ensure that technological solutions do not infringe upon regulatory mandates.

Collaboration between technology developers, legal experts, and industry stakeholders is key to navigating these challenges. Byfostering a dialogue between these groups, the mortgage industry can develop solutions that are both innovative and compliant, ensuring a secure and efficient identity verification process that aligns with legal requirements.

In the realm of the mortgage industry, where the authenticity of customer identity is paramount, implementing secure identity verification strategies is critical. These strategies should not only enhance security but also improve the efficiency and user experience of the verification process.

One of the most effective strategies for secure identity verification is Multi-Factor Authentication (MFA). MFA requires users to provide multiple pieces of evidence to verify their identity, typically something they know (like a password), something they have (like a smartphone), and something they are (like a fingerprint) [4,5]. This method significantly reduces the risk of unauthorized access as it is unlikely for an attacker to compromise all forms of authentication.

The use of biometric verification, such as fingerprint scanning, facial recognition, or iris scanning, offers a high level of security due to the uniqueness of these biological traits [5]. Biometric verification can be more user-friendly and quicker than traditional methods, enhancing customer experience while maintaining security

Blockchain technology can be used to create decentralized and immutable records of identity verifications. This method enhances security by preventing tampering and fraud. It also provides transparency and auditability in the verification process [6,9].

AI and machine learning algorithms can be employed to detect fraudulent activities and anomalies in identity verification processes. These technologies can analyze large amounts of data to identify patterns that are indicative of fraudulent behavior [4,5].

Regularly updating security protocols and conducting audits are crucial to ensure that the identity verification systems are not only up-to-date with the latest security measures but also compliant with relevant regulations [6]. This also involves training employees on the latest security practices and threats.

Ensuring compliance with privacy laws and regulations like GDPR and CCPA is essential. Strategies should include data minimization, obtaining explicit consent for data collection and processing, and ensuring data is handled securely [7,6].

Collaborating with trusted partners who are experts in identity verification can enhance the security and efficiency of the process. These partners can provide specialized knowledge, technologies, and best practices [2,3].

By implementing these strategies, the mortgage industry can bolster its defenses against identity fraud and build a more secure digital ecosystem for its customers.

This paper has explored various aspects of identity assurance in the U.S. mortgage industry, highlighting the critical role of technological advancements and regulatory compliance in shaping secure and efficient identity verification processes. Key findings include:

Frameworks like NIST SP 800-63-3, Kantara Initiative IAF, and OIDC play a pivotal role in establishing standards for identity verification and management, addressing challenges like deepfakes and privacy concerns [1,7,6].

The emergence of deepfake technology and evolving privacy regulations present significant challenges, requiring the mortgage industry to adapt and innovate continually [4,5].

Case studies in financial services demonstrate the potential of FIM to enhance security and streamline identity verification processes, although challenges in implementation and regulatory compliance remain [3,9].

A combination of multi-factor authentication, biometric verification, blockchain technology, AI and machine learning, and privacy compliance form the cornerstone of secure identity verification [2,8,10].

Looking ahead, the mortgage industry stands at a crossroads of opportunity and challenge. The rapid pace of technological advancements offers significant potential to enhance identity verification processes, but it also demands vigilance and adaptability to address emerging threats and regulatory changes.

The ongoing development of technologies like AI, machine learning, and blockchain will likely offer new avenues for securing identity verification processes.

As privacy laws and regulations continue to evolve, the industry must remain flexible and proactive in ensuring compliance, emphasizing the importance of privacy-by-design principles.

Through robust identity assurance practices, the mortgage industry can enhance consumer trust, which is crucial in an era where data privacy and security are paramount.

Strengthening partnerships between financial institutions, technology providers, and regulatory bodies will be essential in developing comprehensive and secure identity assurance solutions. In conclusion, the mortgage industry's journey towards secure and efficient identity assurance is ongoing. By embracing technological innovation, adhering to regulatory standards, and prioritizing consumer privacy and trust, the industry can navigate the complexities of digital identity verification, setting a benchmark for other sectors in the digital economy