Evaluating Financial Risks of Carbon Capture in the Oil & Gas Industry Using Advanced Machine Learning Techniques

Author(s): Rohit Nimmala

Abstract

This paper thoroughly examines the financial risks and opportunities related to implementing carbon capture and storage (CCS) in the oil and gas sector. We utilize sophisticated machine learning techniques to create a robust methodology for measuring CCS projects’ economic feasibility and risk level. Our approach encompasses various crucial factors, such as investment costs, operational expenditures, carbon pricing, and the oil and gas market dynamics. By utilizing discounted cash flow modeling, sensitivity analysis, and Monte Carlo simulation, we produce probabilistic financial results that offer valuable insights for decision-makers. The findings emphasize the crucial significance of policy backing, technological progress, and strategic portfolio management in influencing the financial outcomes of CCS investments. This study enhances the comprehension of Carbon Capture and Storage (CCS) as an essential instrument for reducing carbon emissions in the oil and gas industry while effectively managing the intricate financial aspects of transitioning to cleaner energy sources.

Introduction

The imperative to address climate change has exerted significant pressure on the oil and gas sector to diminish its carbon emissions substantially. Given the expectation that fossil fuels will continue to play an essential role in the global energy mix for many years, carbon capture and storage (CCS) has become a crucial technology for reducing carbon emissions in this sector. CCS entails the capture of carbon dioxide (CO2) emissions from industrial processes or power generation, followed by their transportation and permanent storage underground in geological formations. CCS, or carbon capture and storage, allows for the ongoing utilization of fossil fuels in a world that is limited in carbon emissions by preventing the release of CO2 into the atmosphere. Nevertheless, the widespread implementation of CCS encounters substantial financial obstacles, such as excessive initial investments, intricate operational procedures, and uncertainties regarding forthcoming carbon prices and regulations. Amidst the energy transition, oil and gas companies must thoroughly comprehend the financial risks and opportunities linked to CCS investments to make informed decisions and engage in strategic planning. This paper seeks to meet this requirement by utilizing sophisticated machine learning methods to measure CCS projects’ economic feasibility and risk characteristics in the oil and gas sector. Our goal is to assist the industry in effectively managing the financial aspects of decarbonization and positioning itself for long-term sustainability in a low-carbon future by offering a data-driven framework for evaluating CCS investments.

Overview of CCS Technologies Main Types of CCS

- Pre-Combustion: This process involves gasifying the fossil fuel to create syngas, which are then treated to separate the CO2 before the remaining hydrogen-rich gas is used for power generation or industrial processes.

- Post-Combustion: This method captures CO2 from the exhaust gases after combining the fossil fuel. The most common technique is amine scrubbing, where the exhaust gas passes through a solution that absorbs the CO2.

- Oxyfuel Combustion: In this process, the fuel is combusted in an oxygen-rich environment, resulting in a highly concentrated CO2 stream that is easier to capture and

The Current State of CCS Deployment in the Oil and Gas Sector CCS deployment in the oil and gas sector is still relatively limited, with only a handful of large-scale projects in operation globally. However, the industry has increasingly invested in CCS to reduce its carbon footprint and comply with tightening regulations. Some notable projects include:

- Sleipner CCS Project (Norway): Captures CO2 from natural gas processing and stores it in an offshore saline aquifer.

- Quest CCS Project (Canada): Captures CO2 from oil sands upgrading and stores it in an onshore saline aquifer.

- Gorgon CCS Project (Australia): Captures CO2 from LNG production and stores it in an offshore saline aquifer.

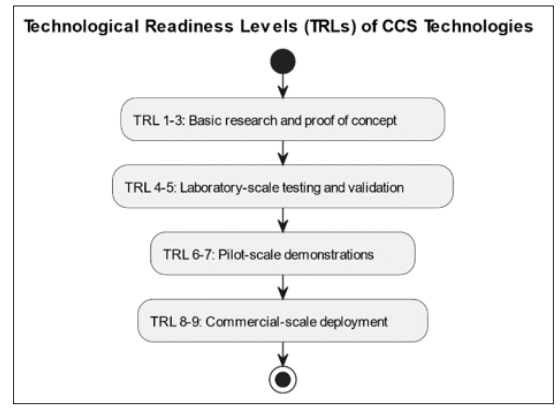

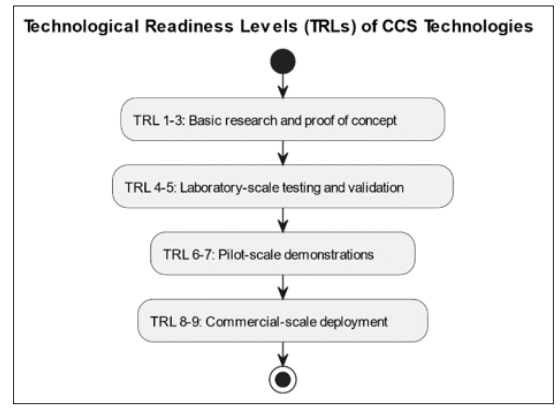

Technological Readiness Levels (TRLs) and Expected Future Improvements

The TRLs of CCS technologies vary depending on the specific application and process involved. Post-combustion capture using amine scrubbing is the most mature technology (TRL 7-9), while pre-combustion and oxyfuel combustion is less advanced (TRL 5-7).

Expected Future Improvements in CCS Technologies Include

- Advanced solvents and sorbents for more efficient CO2 capture

- Improved process integration and heat management to reduce energy penalties

- Novel materials for CO2 transport and storage, such as metal- organic frameworks

- Machine learning and digital technologies for optimizing CCS operations and reducing costs

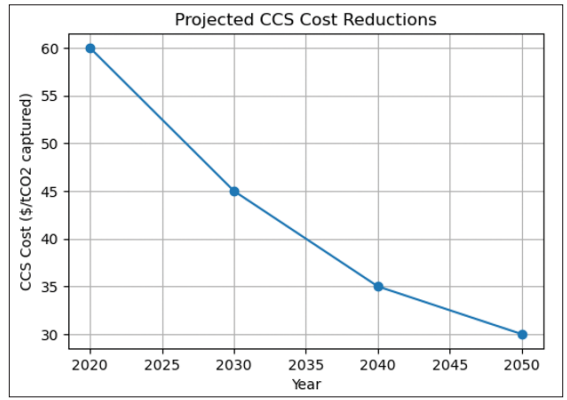

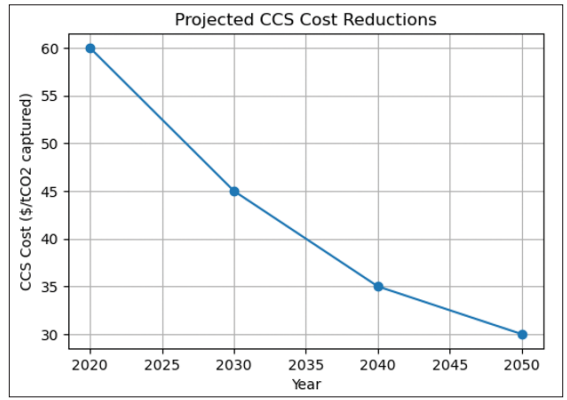

This graph shows a hypothetical trajectory of CCS cost reductions over time as technologies mature and economies of scale are achieved. Such cost reductions will be critical for the widespread adoption of CCS in the oil and gas sector and beyond.

Regulatory and Policy Landscape

We will discuss policy incentives and support for CCS and consider how climate-related disclosure requirements may drive CCS investment.

Carbon Pricing Mechanisms and their Impact on CCS Adoption

Carbon pricing mechanisms, such as carbon taxes and cap- and-trade systems, are designed to establish a monetary value for greenhouse gas emissions to encourage carbon emissions reduction. These mechanisms can have a substantial effect on the financial sustainability of CCS projects by generating income from captured CO2 and imposing penalties on emissions that are not captured. For instance, implementing a carbon tax of $50 per metric ton of CO2 would enhance the appeal of carbon capture and storage (CCS) by raising the price of CO2 emissions and offering a corresponding financial incentive for capturing and storing CO2

Other Policy Incentives and Support for CCS

In addition to carbon pricing, governments can support CCS deployment through various policy incentives, such as:

- Tax Credits: The 45Q tax credit in the United States provides a credit of $50/tCO2 for CO2 permanently stored in geological formations and $35/tCO2 for CO2 used in enhanced oil recovery (EOR) or other beneficial uses.

- Grants and Low-Interest Loans: Governments can provide funding to support the development and deployment of CCS

- Mandates and Standards: Policymakers can set requirements for industries to capture and store a certain percentage of their CO2 emissions.

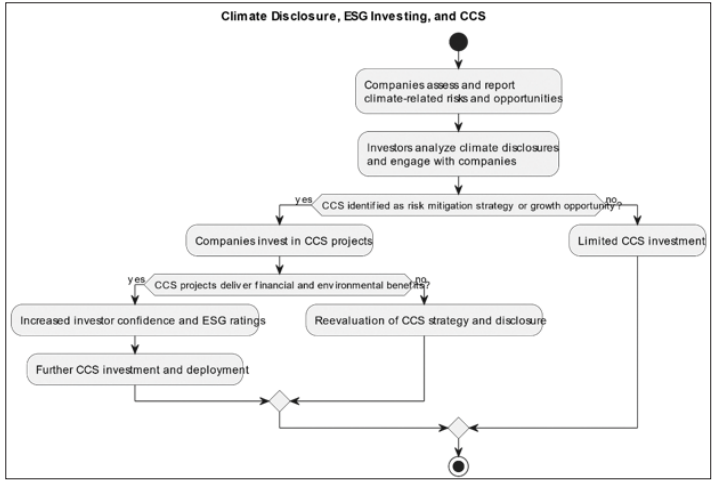

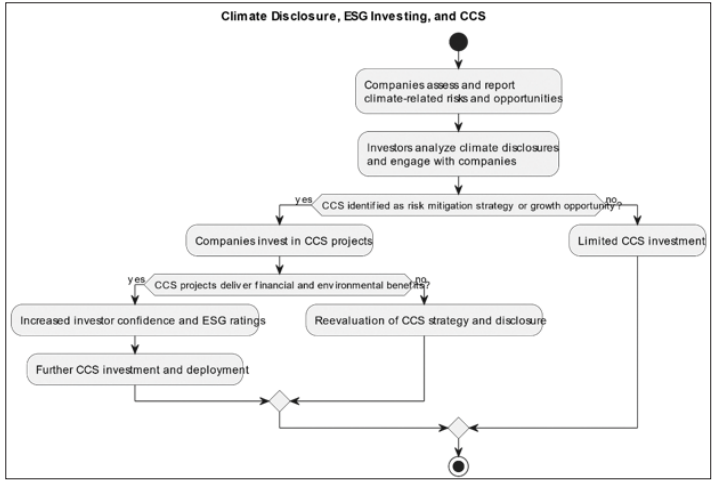

Climate-Related Disclosure Requirements and CCS Investment Climate-related disclosure frameworks, such as the Task Force on Climate-related Financial Disclosures (TCFD), encourage companies to assess and report their exposure to climate-related risks and opportunities. These requirements can drive CCS investment in several ways:

- Identifying CCS as a Risk Mitigation Strategy: Companies may recognize CCS to reduce their exposure to transition risks, such as carbon pricing and regulations.

- Highlighting CCS as a Growth Opportunity: Disclosure frameworks can help companies identify CCS as a potential source of revenue and competitive advantage in a low-carbon economy.

- Attracting ESG Investors: Companies with solid climate disclosures and a proactive approach to decarbonization, including CCS investment, may be more attractive to investors focused on environmental, social, and governance (ESG) factors.

(This diagram illustrates the potential feedback loop between climate disclosure, investor engagement, and CCS investment, highlighting the importance of transparent and decision-useful disclosures in driving the deployment of CCS technologies).

Financial Analysis of CCS Projects

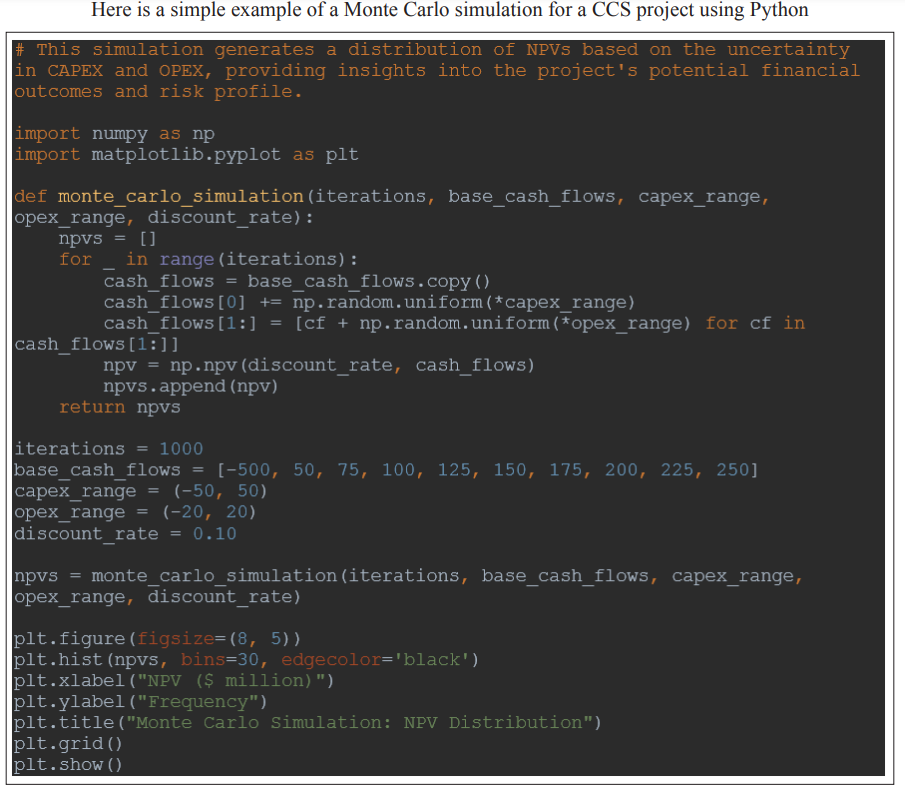

In this section, let us discuss a discounted cash flow (DCF) model to evaluate CCS project economics, discuss the critical input variables, perform sensitivity analysis, and use Monte Carlo simulation to generate various potential financial outcomes.

Discounted Cash Flow Model for CCS Project Economics A DCF model is a powerful tool for assessing the financial viability of CCS projects. The model estimates the present value of future cash flows based on projected revenues, costs, and investments over the project’s lifetime. The critical steps in building a DCF model for a CCS project are:

- Project Cash Inflows: Estimate revenues from CO2 capture credits, enhanced oil recovery (EOR), and other sources.

- Project Cash Outflows: Estimate capital expenditures (CAPEX), operating expenses (OPEX), and taxes.

- Determine Discount Rate: Use the weighted average cost of capital (WACC) or a risk-adjusted rate to account for project uncertainties.

- Calculate Net Present Value (NPV) and Internal Rate of Return (IRR): Discount the future cash flows to determine the project’s NPV and IRR.

Key Input Variables and Sensitivity Analysis

The DCF model’s accuracy depends on the quality of its input variables. For a CCS project, the critical input variables include:

- Capital costs (CAPEX)

- Operating costs (OPEX)

- CO2 prices

- Oil/gas prices (for EOR projects)

- Tax incentives (e.g., 45Q tax credit)

Sensitivity analysis helps assess the impact of changes in these variables on the project’s financial performance. We can identify the most critical variables by varying one input at a time and understand the project’s risk profile.

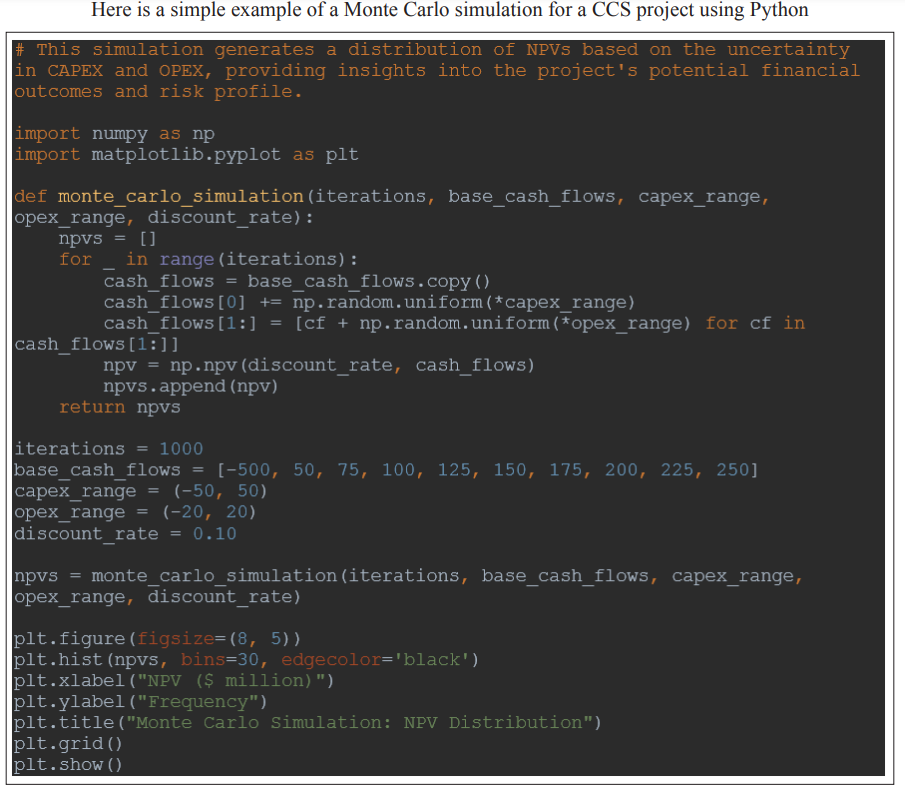

Monte Carlo Simulation for Potential Financial Outcomes Monte Carlo simulation is a technique that helps quantify the uncertainty in a CCS project’s financial performance by generating a range of possible outcomes based on the probability distributions of key input variables. The steps in running a Monte Carlo simulation are:

- Define probability distributions for crucial input

- Run multiple iterations of the DCF model, randomly sampling input values from their respective distributions.

- Analyze the distribution of output metrics (e.g., NPV, IRR) to understand the project’s risk profile.

Strategic Considerations

We will analyze the portfolio by comparing the risk and return of CCS with other decarbonization options. Additionally, we will explore the potential of CCS to prolong the lifespan of oil and gas assets in a world with carbon constraints. Furthermore, we will examine the possibilities of monetizing CCS through carbon trading and low-carbon product premiums.

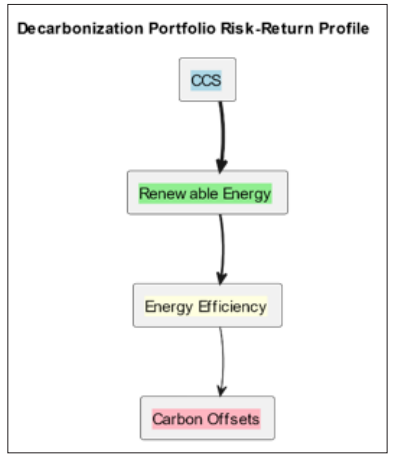

Comparative portfolio analysis examining the risk and return of Carbon Capture and Storage (CCS) about alternative decarbonization options:

An oil and gas company’s decarbonization strategy should encompass a range of options, such as carbon capture and storage (CCS), investments in renewable energy, enhancements in energy efficiency, and offsetting emissions by purchasing carbon credits. A portfolio analysis can facilitate comparing the risk and return characteristics of these options and guide investment decisions.

Key Considerations in a Portfolio Analysis Include

- Expected Returns: Estimate the potential financial returns of each decarbonization option based on factors such as market demand, carbon pricing, and technology costs.

- Risks: Assess the risks associated with each option, including technology uncertainties, policy changes, and market

- Diversification: Aim for a balanced portfolio that spreads risk across multiple decarbonization options and geographies.

- Alignment with Company Strategy: Ensure that the decarbonization portfolio aligns with the company’s overall business strategy and core competencies.

Potential for CCS to Extend Life of Oil and Gas Assets in a Carbon-Constrained World

Carbon capture and storage (CCS) can significantly contribute to the longevity of oil and gas assets by diminishing their carbon emissions and allowing them to function effectively in a world with carbon restrictions. CCS, or carbon capture and storage, enables oil and gas companies to maintain fossil fuel production while complying with more demanding emissions regulations by capturing and storing CO2 emissions.

Some Key Benefits of CCS for Extending Asset Life Include

- Compliance with emissions regulations: CCS can help oil and gas assets comply with current and future emissions regulations, avoiding potential penalties or premature

- Maintaining social license to operate: By demonstrating a commitment to decarbonization through CCS, oil and gas companies can maintain their social license to operate and reduce the risk of public opposition or divestment

- Bridging the gap to a low-carbon future: CCS can serve as a bridge technology, allowing oil and gas companies to continue operating while transitioning to cleaner energy sources.

Opportunities for Monetizing CCS through Carbon Trading and Low-Carbon Product Premiums

CCS can create new revenue streams for oil and gas companies through carbon trading and low-carbon product premiums. By capturing and storing CO2, companies can generate carbon credits that can be sold in compliance or voluntary carbon markets.

Additionally, products derived from CCS-enabled processes, such as low-carbon hydrogen or electricity, may command price premiums from consumers seeking to reduce their carbon footprint.

Some Critical Opportunities for Monetizing CCS Include

- Carbon Credit Sales: Participate in carbon markets by selling credits generated through CCS projects.

- Low-Carbon Product Premiums: Develop and market low-carbon products, such as blue hydrogen or low- carbon electricity, that can command price premiums from environmentally conscious consumers.

- Enhanced Oil Recovery (EOR): Use captured CO2 for EOR, increasing oil production while sequestering CO2 and potentially generating additional revenue through carbon credit sales.

- Partnerships and Joint Ventures: Collaborate with other companies or industries to develop shared CCS infrastructure and maximize economies of scale.

Conclusion

This paper thoroughly examines the financial risks and opportunities linked to implementing carbon capture and storage (CCS) in the oil and gas sector. We have used sophisticated machine learning techniques to create a reliable method for measuring the economic feasibility and level of risk associated with CCS projects.

The Main Insights from Our Financial and Risk Analysis Include

- CCS projects can be economically viable under certain conditions, such as high carbon prices, favorable tax incentives, and successful monetization of captured CO2 through enhanced oil recovery or carbon credit sales.

- The financial performance of CCS projects is susceptible to crucial input variables, such as capital costs, operating expenses, and CO2 prices. Sensitivity analysis and Monte Carlo simulations can help quantify the impact of these variables and assess project risks.

- CCS can play a strategic role in oil and gas companies’ decarbonization efforts by extending the life of fossil fuel assets, enabling compliance with emissions regulations, and providing a bridge to a low-carbon future.

- Successful implementation of CCS requires a supportive policy and regulatory environment, including carbon pricing mechanisms, tax incentives, and climate disclosure requirements that encourage investment in low-carbon

Based on these Insights, We Recommend that Oil and Gas Companies Consider Pursuing CCS as Part of their Decarbonization Strategies, with the following Caveats

- Conduct thorough financial and risk analysis to ensure that CCS projects align with the company’s risk-return profile and overall business strategy.

- Develop a diversified decarbonization portfolio that balances CCS with other low-carbon options, such as renewable energy investments and efficiency improvements.

- Actively engage with policymakers and stakeholders to shape a supportive regulatory environment for CCS, including advocating for carbon pricing and other incentives.

- Invest in research and development to reduce costs and improve the performance of CCS technologies over time.

- Collaborate with industry partners and other stakeholders to develop shared CCS infrastructure and knowledge, maximizing economies of scale and reducing project risks.

Areas for Further Research Include

- Refining machine learning models to improve the accuracy and granularity of CCS project financial analysis, incorporating a more comprehensive range of input variables and risk

- Exploring the potential for CCS to enable novel low- carbon business models, such as carbon-negative hydrogen production or direct air capture and storage.

- Investigating the role of CCS in the context of the circular carbon economy, including opportunities for CO2 utilization in industrial processes and products.

- Analyzing the social and environmental co-benefits of CCS, such as job creation, air quality improvements, and contributions to the United Nations Sustainable Development

Oil and gas companies can become leaders in the energy transition and contribute to the global effort to combat climate change by following these research directions and implementing the recommended strategies for managing the financial risks and opportunities associated with CCS deployment [1-11].

References

- Bui M, Adjiman CS, Bardow A, Anthony EJ, Boston A, et (2018) Carbon capture and storage (CCS): the way forward. Energy & Environmental Science 11: 1062-1176.

- Rubin ES, Davison JE, Herzog HJ (2015) The cost of CO2 capture and International Journal of Greenhouse Gas Control. Elsevier BV 40: 378-400.

- (2020) Energy Technology Perspectives. OECD http://dx.doiorg/10.1787/ab43a9a5-en. .

- Matthew E Boot-Handford, Juan C Abanades, Edward J Anthony, Martin J Blunt, Stefano Brandani, et al. (2014) Carbon capture and storage update. Energy Environ Sci 7:

- Leung DYC, Caramanna G, Maroto-Valer MM (2014) An overview of current status of carbon dioxide capture and storage technologies. Renewable and Sustainable Energy Reviews 39: 426-443.

- Meckling J, Kelsey N, Biber E, Zysman J (2015) Winning coalitions for climate policy. American Association for the Advancement of Science (AAAS) 349: 1170-1171.

- (2019) Negative Emissions Technologies and Reliable Sequestration. National Academies Press http://dx.doiorg/10.17226/25259. .

- Budinis S, Krevor S, Dowell NM, Brandon N, Hawkes (2018) An assessment of CCS costs, barriers and Energy Strategy Reviews 22: 61-81.

- Haszeldine RS, Flude S, Johnson G, Scott V (2018) Negative emissions technologies and carbon capture and storage to achieve the Paris Agreement commitments. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences 376: 20160447.

- Arnulf Grubler, Xuemei Bai, Thomas Buettner, Shobhakar Dhakal, David Fisk, et al. (2012) Urban Energy Systems. Global Energy Assessment (GEA). Cambridge University Press 1307-1400.

- Tcvetkov P, Cherepovitsyn A, Fedoseev S (2019) The Changing Role of CO2 in the Transition to a Circular Economy: Review of Carbon Sequestration Projects. Sustainability 11: 5834.

View PDF