Author(s): Anil J N Shukla and Lau Chew King*

The International Accounting Standards Board (IASB) proposed several amendments to International Accounting Standards 7 (IAS 7) in December 2019. One of the proposed amendments is to allow companies to continue with the choice between Direct Method (DM) and Indirect Method (IM) in the presentation of the statement of cash flows (SCF).

The International Accounting Standards Board (IASB) proposed several amendments to International Accounting Standards 7 (IAS 7) in December 2019. One of the proposed amendments is to allow companies to continue with the choice between Direct Method (DM) and Indirect Method (IM) in the presentation of the statement of cash flows (SCF). Recently, in July 2020, companies were also urged by the Accounting and Corporate Regulatory Authority and Singapore Exchange Regulation (SGX Reg Co) to provide high-quality financial statements. Such statements should contain comparable and relevant information to keep investors well-informed, especially on the financial impact of Covid-19 [1]. As such, we believe it might be an appropriate time to revisit the issue of which method, DM or IM, is more likely to meet regulators’ requirement of “high-quality” financial statements.

We use the following illustration to contrast the differences between DM and IM in the preparation of the SCF

Assume that at the end of the financial year 30 June 20x1, ABC Company recognised sales of $900 and incurred costs of goods sold of $700 and other expenses of $120. Its profit before tax was therefore $80 as shown in Figure 1. As shown in Figure 2, in its statement of financial position, ABC has an increase in working capital that corresponds with increases in accounts receivable, inventories and accounts payable of $200, $200 and $80 respectively [2].

Figure 1: Statement of Profit or Loss

| ABC Statement of Profit or Loss For the Financial Year Ended 30 June | |

| 20x1 | |

| S$ | |

| Sales | 900 |

| Costs of Goods Sold (COGS) | (700) |

| Gross Profit | 200 |

| Other Expenses - non-cash | (120) |

| Profit Before Tax | 80 |

Figure 2: Statement of Financial Position

| ABC Statement of Financial Position As at Financial Year Ended 30 June | ||

| 20x1 | 20x0 | |

| S$ | S$ | |

| Accounts Receivable (AR) | 300 | 100 |

| Inventories | 300 | 100 |

| Accounts Payable (AP) | 200 | 120 |

Based on these assumptions, the total cash receipts of ABC for the financial year is $700 and the total cash payments to its suppliers is $820 [3].

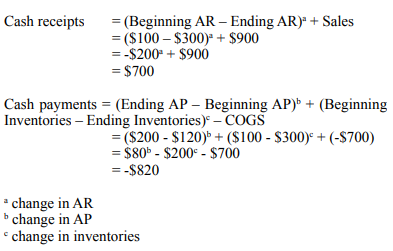

The cash receipts and cash payments are derived as follows based on a simple accounting concept:

In Figure 3 (DM), the DM is used to present the SCF. The cash inflows of $700 received from customers and cash outflows of $820 paid to employees and suppliers are directly reflected on the face of the statement. In contrast, in Figure 4 (IM) where the IM is used, a list of adjustments from the profit before tax is presented on the SCF. The exact cash inflows and outflows for the financial year is not clearly represented and the list of adjustments cannot be easily understood by users.

IAS 7 also allows for an alternative presentation using the IM. This is shown in Figure 5 (IM-Alt), which disaggregates profit before tax into sales (excluding investment income) of $900 and operating expenses (excluding depreciation) of $700 on the face of the statements. This format eliminates the adjustments of noncash items from profit before tax. However, the remaining items of operating activities are no different from the original IM (as shown in Figure 4). Thus, beyond the information about the components of profit before tax provided by the alternative format, there is no incremental information about actual cash inflows and outflows. This suggests that the alternative IM presentation format may not further help users in understanding the company’s cash flows [4].

Figure 3: Direct Method (DM)

| ABC Statement of Cash Flows For the Financial Year Ended 30 June | |

| Operating activities | 20x1 |

| S$ | |

| Cash receipts from customers | 700 |

| Cash payments to suppliers | (820) |

| Cash used in operating activities | (120) |

Figure 4: Indirect Method (IM)

| ABC Statement of Cash Flows For the Financial Year Ended 30 June | |

| Operating activities | 20x1 |

| S$ | |

| Profit Before Tax | 80 |

| Adjustments: (for non-cash profit or loss items) Other Expenses | 120 |

| 200 | |

| Changes in Working Capital: | |

| Increase in Accounts Receivable | (200)a |

| Increase in Inventory | (200)c |

| Increase in Accounts Payable | 80b |

| Cash used in operating activities | (120) |

Figure 5: Alternative Indirect method (IM-Alt)

| ABC Statement of Cash Flows For the Financial Year Ended 30 June | |

| Operating activities | 20x1 |

| S$ | |

| Sales excluding investment income | 900 |

| Operating expenses excluding depreciation | (700) |

| Operating profit before working capital changes | 200 |

| Changes in Working Capital: | |

| Increase in Accounts Receivable | (200)a |

| Increase in Inventory | (200)c |

| Increase in Accounts Payable | 80b |

| Cash used in operating activities | (120) |

In Figure 3 (DM), the dollar amounts without (with) parenthesis simply represent cash inflows (cash outflows). The use of the parenthesis is consistently applied in the entire statement from operating activities to the reconciliation of cash and cash equivalent. With this consistency, users can easily understand where a company’s cash is generated, and where it is expended under the different business activities (i.e., operating, financing and investing).

However, this is not the case in the IM presentation formats. Since the IM starts with profit before tax, the dollar amounts with or without parenthesis simply represent a set of adjustments. The adjustments are basically due to the accounting concept of accruals, which recognises sales and expenses when incurred, and not when cash flows occurred. The accrual concept also impacts the statement of financial position, including line items such as accounts receivable, inventories, and accounts payable. To determine the cash generated from or used in operating activities, non-cash items from sales and expenses as well as changes in working capital have to be adjusted out from the profit before tax. As a result, the dollar amounts with or without parenthesis presented in operating activities do not directly represent cash inflows and cash outflows. Similar adjustments apply in the alternative IM method in Figure 5, which starts with the sales number. Many users are unaware of this convention and therefore may misinterpret a company’s overall cash flow position.

We randomly selected 100 listed companies, in various industries, from the Singapore Stock Exchange to examine the choice of presentation method for the SCF. Of the 100 companies, 98 of them adopted IM over DM in the preparation and presentation of their SCF. The two companies that adopted DM are foreign-registered companies. Furthermore, none of the companies which adopted IM used the alternative IM presentation format.

Although the DM presentation format is more easily understood by the users as compared to the IM, companies typically require more time in tracing and gathering cash flows information necessary for DM presentation This is unlike the IM, which typically requires less time and effort since adjustments can be made once the statements of financial position and the statement of profit or loss are ready. Thus, the result of the empirical investigation suggests that there is a trade-off between costs and understandability in the preparation of financial statements by listed companies in Singapore [5].

The SCF is crucial to users as it provides relevant information regarding cash inflows and outflows of a company that arise from its operating, investing and financing activities during a financial period. This information enables users to evaluate a company’s ability to generate cash and cash equivalents and to manage its financial structure, liquidity and solvency.

As compared to both IM presentation formats, the DM provides clearer and more straightforward cash flows information that can aid decision making by users of financial statements. In addition, the DM displays the information more consistently on the entire SCF because of the consistent use of parenthesis to represent actual cash inflows and outflows, mitigating any user confusion. Given the wide acceptance of digitalisation and automation, the tracing of cash inflows and outflows in a company can be done in a costefficient manner. Thus, companies should consider switching from the IM to the DM to provide a “high-quality” SCF that can keep users well informed of the company’s cash and cash equivalents and its financial health.