Author(s): Joseph Aaron Tsapa

In the modern banking world, data analytics have become a significant factor in making operational processes more efficient, more accurate in risk management, and more compliant with regulations. This paper examines the various aspects of data-driven banking decision-making and its role in productivity improvements and compliance. Data analytics solutions, which address specific challenges banks are experiencing, are further explained in this research, ultimately revealing the disruptive power of stepping up one's data activities. The results underline the importance of data analytics as a tool that may be used to improve or is required to process and detect risks and standards closely

Data analytics has become an integral part of the modern banking industry, giving us access to a whole range of insights we can use as management levers that, in turn, help us optimize our processes. Consumption of the banking sector about productivity and compliance brings complex issues that must be addressed in a search for new solutions. The claims of this piece, the primary subject, will be to explain how data-driven data-driven techniques address these challenges inhibiting operational efficiency and how they enable regulatory compliance.

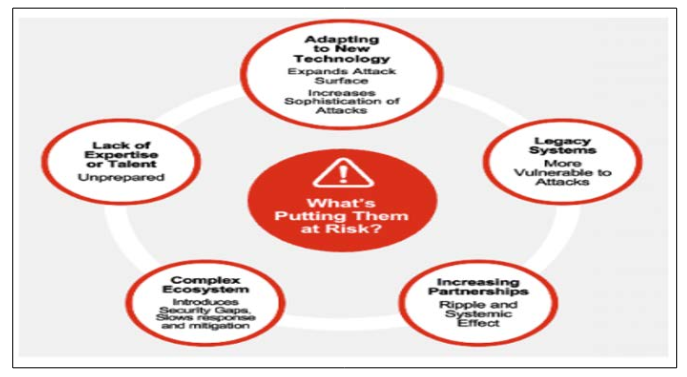

The banking sector faces numerous challenges, some of which are outdated legacy systems, which are highly fragmented, burgeoning regulatory compliance issues, and skyrocketing cybersecurity threats. Such aspects impede the fulfillment of tasks and complicate adherence. Therefore, more time is spent. As a result, this leads to inefficient processes and potential problems.

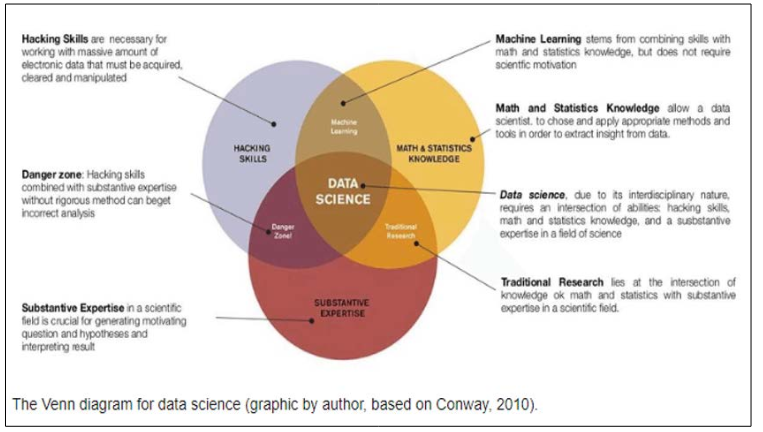

In this context, data analytics is a panacea for the banks' many challenges. The banks can perform elaborated methods of analytics such as replacing predictive modeling and machine learning that help to understand the client's behavior at a greater depth, uncovering the patterns and preferences, and making the strategies and offerings more targeted and personal. Furthermore, banks can use data analytics to optimize their processes, leading to improved efficiency and effective management of operations by identifying those aspects of the operation that have inefficiencies and need enhancement. With the help of predictive modeling, banks can forecast upcoming tendencies in the fields and even change the course of markets, bringing forth proactive actions and managerial decisions. Instead, machine learning-based algorithms allow banks to identify abnormal activities that signify a possibility of theft, reinforcing the bank security measures and lending protection against financial losses. In addition, data analytics creates an avenue for seeing regulations into action through robust monitoring and reporting processes, which makes compliance easy. Using data analysis as a tool empowers banks to improve their internal services, care about reducing risks, and gain an edge in terms of ease of competition.

Deep data penetration allowed banks to use it in various circles inside the bank, such as customer segmentation, analysis of credit risk, fraud detection and monitoring, and reporting to regulators. Banks divide financial activities, demographics, and transactional behavior into various clusters, which can be grouped into tailormade segments for customer segmentation. These further break into much more personalized marketing strategies, which enhance the in-depth market intelligence, hence increasing knowledge of what the customer prefers and requires-maximizing customer satisfaction and loyalty. Also, data analytics has a crucial position in assessing credit risk when it comes to historical data, transactional behavior, and other factors that reflect the ability of debtors to make proper repayments. This allows them to conduct an exhaustive, individualized lending process for each borrower, minimizing the amount of defaulted loans and bettering the loan portfolio.

Sophisticated algorithms also analyze gigantic volumes of data, looking for abnormal patterns that suggest a possibility of fraud to users. Therefore, security is enhanced within the system while reducing risks. The fintech industry's data analytics capabilities streamline regulatory compliance by automating the processes of data gathering, validation, and assessment. This ensures that all necessary regulatory standards are consistently met. Using varied use signs, data analytics is a game changer in banking operations; it improves efficiency, maintains innovation, and beats the odds in the banking market.

Making the most of data analytics is beneficial to the banking sector operationally and crucial to generating revenue. Banks get data-driven insights, which will help them to make the processes lean, resource allocation will become more optimized, and operational bottlenecks will be minimized, leading to cost reduction and resource underutilization. According to PwC, 46% of respondents felt that cyber security was the most challenging area regarding future technology. Furthermore, banking gets a boost from data analytics through a faster understanding of the problems likely to affect banks in real time, thus enabling prompt response strategies to reduce risks and build resilience. Moreover, data analytics helps banks comply with the standards set up by regulating authorities through automated promoting requirements, detecting questionable transactions, and auditing records. It is a safeguard against regulatory infringements and an excellent tool to prevent and cut the associated consequences and fines. To sum up, using data analytics serves to completely remake the banking skyline, resulting in its being powered by innovation, agility, and competition. At the same time, the players' sense of safety and trust is being preserved.

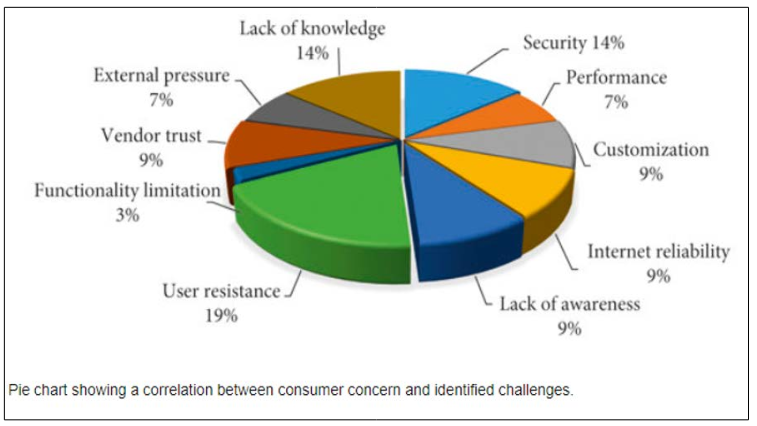

Severe adoption of accurate analytics accompanies the adoption of digital analytics in financial institutions, as with other technologies. Issues such as the protection of privacy that arise due to intensive data collection and analysis of customer data raise questions about the scope of data usage and regulation, especially with consumers' consent. Data security is worsened when a vast amount of data analytics is used. These calls for more impervious cybersecurity measures to forestall hacking and data breaches. As for the need for more skilled analytics professionals, it stands as the insurmountable obstacle to the implementation, and banks are in the vanguard of dealing with its challenges, which are brought on by the rising call for specialization in data science and analytics. Besides achieving interoperability of the different subsystems and the perfect integration of the data from various sources, despite that fact, a severe technical challenge will remain a big problem. Efforts to override privacy issues, accidents, and data breaches call for a joint force to ensure security in cyberspace. Modern banks also make it possible by investing in talent engagements and the use of technology to create space for data integration.

Data analytics leads to exceptional transformations in the banking industry, increasing cost efficiency and performing a risk mitigation function. Banks can help the economy deal with specific issues and simultaneously decision-making to create new growth and development opportunities. However, the successful adoption of such solutions needs a proper strategic approach, technology investment, and cross-functional relationship development [1-9].