Author(s): Bhupinder Paul Singh Sahni

As more and more Investment banks, Hedge Fund Companies and Financial Institutions are investing in their Trading Platforms to achieve best possible Trading Solutions, it becomes very important to understand what trading scenarios need to be tested to ensure a robust and reliable product. A small glitch in the trading applications can have significant financial and reputational implications. It can cause companies to lose millions of dollars in transactions, there could be regulatory fines and penalties, litigation costs, and the reputation of the Company could also be at risk. This paper studies different scenarios that should be considered to be tested for OTC and ETF Trading Applications, to mitigate the risk of technical glitches and their adverse effects on the company.

Trading Applications are quite complex, interacting with different external systems to fetch Market Data, pricing data, algorithmic trading strategies, different APIs connecting to different clients and dealers, downstream systems for reporting, etc. for all the Trade Flow Activities at Front Office, Middle Office and the Back Office. Different Clients and Dealers based on the Funds or Instruments they are trading on use different functionalities, and all apps are heterogeneous. A single system or a Trading Application might have a whole package of products ranging from Bonds, Derivatives, Stocks, etc. and each configured individually according to the way they are traded and based on each product’s regulatory requirements. All the systems require integration with numerous venues, making the overall system quite complex.

To add to the complexity of financial trading systems; increased competition, higher market data volume, and newer regulatory demands makes Firms try to maintain their competitive edge by constantly changing their trading strategies and increasing the speed of trading. Thus, considering the money and complexity of the Trading Applications, it becomes very important that whenever these Trading Applications are developed or upgraded with new functionalities, these systems should be thoroughly tested.

There are various financial Instruments trading on Primary Market and/ or the Secondary Market, on OTC Trading Applications and/ or ETF Trading Applications. The purpose of this paper is to detail out the similarities and differences in test scenarios to be considered while doing the Quality Assurance of OTC Trading Application versus an ETF Trading Application in secondary Market. But in order to understand the test scenarios to be tested on these Trading Applications, we will first explain the key differences between OTC and ETF Trading in Secondary Market.

To understand what needs to be tested for OTC and ETF Trading Applications in Secondary Market, we need to understand first what OTC and ETFs stand for in the Investment Banking World and what it means by Secondary Market.

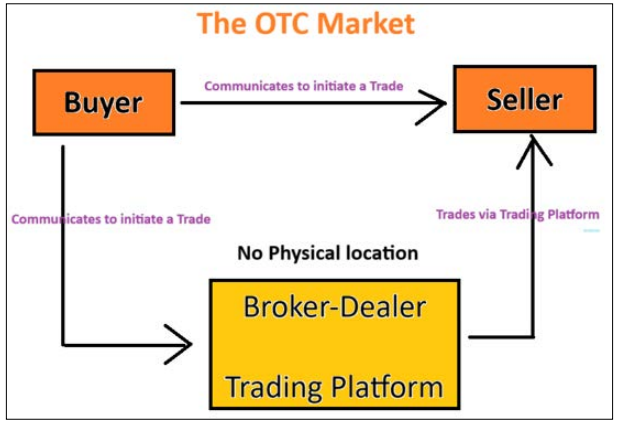

OTC stands for Over-the-Counter. The over-the-counter (OTC) market refers to the trading of securities outside of a formal exchange, usually in a broker-dealer network. Companies that list their securities on over-the-counter markets may not meet the regulatory requirements for listing on an exchange, and therefore turn to this alternative market to raise capital. A trade can be executed between two participants in an OTC market without others being aware of the price at which the transaction was completed. A variety of financial products can be traded over the counter, including stocks, bonds, commodities, and derivatives [1].

OTC (Over-the-Counter) trading applications are software trading platforms or systems used by traders to execute trades in financial instruments directly with counterparties, outside of traditional exchanges, primarily in the Secondary Market.

Some examples of OTC trading platform, also known as Broker- Dealer Trading platform include Bloomberg, Market Axess, Tradeweb, Bond Vision, etc.

ETF stands for Exchange-Traded Funds. An exchange-traded fund (ETF) are hybrid investment vehicles that can be bought and sold like an individual stock and traded on an exchange. Like traditional mutual funds, most ETFs invest in a diversified portfolio of stocks and bonds. Unlike traditional mutual funds, ETFs trade on a stock exchange [2].

Some examples of ETF trading applications include online brokerage platforms offered by brokerage firms, investment management platforms, and financial technology companies.

The secondary market is where investors buy and sell securities previously issued securities. Trades take place on the secondary market between other investors and traders rather than from the companies that issued the securities [3]. Both OTC and ETF trades are traded on Secondary Market.

Examples of Secondary market include national exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ.

Although there are differences in Trading style of OTC and ETF Trading Applications, but there are many similarities in Testing these two different types of Trading Applications. There are key areas that need to be tested for both types of trading applications, some of them are listed below:

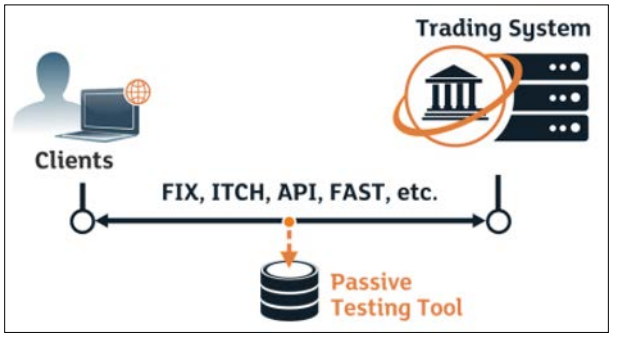

For API Testing, various Testing Tools also known as Passive testing tools are used for automated log collection, data structuring, monitoring, system behavior analysis and user certification [5]. Test tools allow analyzing high volume of data promptly, reacting to deviations in the system?s behavior from requirements, and troubleshooting [6].

As Trading systems interact with different other upstream, downstream and other applications like pricing engine, market data, Client and Dealer systems, etc, so it is imperative to include Integration Testing of these Applications. Some examples of Integration Testing on OTC and ETF Trading applications include:

Both OTC and ETF Trading Applications have functional requirements that need to be tested. There are common functional requirements across OTC and ETF Trading platforms and should be tested to ensure the new functionalities work properly as per business specifications. Some key aspects of Testing Functional requirements on OTC and ETF Trading platforms could be as below [4].

Depending on the number of systems that Trading Applications interact with, a greater number of test scenarios can be added to verify integration between them. Usually, Integration Testing is done after functional testing is complete.

Security testing is essential for trading applications to protect financial assets, maintain market integrity, comply with regulatory requirements, mitigate cyber threats, preserve customer trust, safeguard intellectual property, and ensure business continuity and resilience. Trading Applications carries sensitive data which includes company/ trader information, trade information and other sensitive information, due to which security testing imperative to be done on Trading applications.

Testing OTC (Over-the-Counter) and ETF (Exchange-Traded Fund) trading applications involves considerations specific to each type of trading platform due to their distinct characteristics, products supported and functionalities. Some key differences in testing ETF and OTC trading applications are listed below:

ETF Trading Applications: ETFs trade on exchanges, where liquidity is typically higher due to the presence of market makers and continuous trading happening on Exchanges. Testing should focus on order execution efficiency, liquidity sourcing, and market impact on ETF applications.

OTC Trading Applications: OTC securities trade directly between counterparties outside of centralized exchanges, often resulting in lower liquidity and wider bid-ask spreads. Testing should assess counterparty risk management, price discovery mechanisms, and settlement processes.

ETF Trading Applications: ETF orders are executed on exchanges using standard order types such as market orders, limit orders, and stop orders. Testing should verify the accuracy and speed of order execution, order routing algorithms, and compliance with exchange rules.

OTC Trading Applications: OTC trades involve negotiated terms between counterparties, allowing for more flexibility in order types and execution methods. Testing should ensure proper handling of negotiated trades, and bilateral agreements.

ETF Trading Applications: ETF trading is subject to regulatory oversight by entities such as the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA) and exchange-specific regulations. Testing should focus on compliance with regulatory requirements for ETF creation/ redemption, reporting, and disclosure.

OTC Trading Applications: OTC trading may involve compliance with regulatory frameworks such as the Dodd-Frank Act for derivatives trading or MiFID II for European markets. Testing should assess compliance with trade reporting, transparency, and best execution obligations.

ETF Trading Applications: ETF trades settle through centralized clearinghouses, reducing counterparty risk and streamlining settlement processes. Testing should verify the accuracy and efficiency of trade settlement, including delivery versus payment (DVP) mechanisms.

OTC Trading Applications: OTC trades involve direct counterparty relationships, increasing counterparty risk and settlement complexity. Testing should assess counterparty credit risk management, collateralization practices, and settlement procedures.

ETF Trading Applications: ETF prices are determined by the underlying securities’ market prices, which are publicly available and continuously updated. Testing should ensure accurate market data dissemination, pricing transparency, and fair valuation mechanisms.

OTC Trading Applications: OTC securities may lack public market prices, requiring alternative pricing sources and valuation methods. Testing should validate the accuracy and reliability of pricing data, mark-to-market procedures, and valuation models.

ETF Trading Applications: ETF trading platforms implement risk management controls to monitor trading activity, detect anomalies, and prevent market abuse. Testing should evaluate risk controls, surveillance algorithms, and compliance with exchange rules.

OTC Trading Applications: OTC trading platforms must manage counterparty credit risk, operational risk, and market risk associated with bilateral transactions. Testing should assess risk mitigation measures, credit risk assessment tools, and compliance with risk management standards.

Next-generation trading architectures have to respond to increased demands for speed, volume, and efficiency. In order to have new features and architecture for trading applications, it becomes extremely important to test the trading applications before they are deployed in Production. Some of the test scenarios for testing OTC and ETF Trading applications have been described above, but there could be more scenarios depending on the configuration and complexity of the system, interactions with other systems and Business requirements. Tailoring testing approach according to these factors, developers and testers can ensure the robustness, reliability, and compliance of ETF and OTC trading applications in their respective market environments.