Author(s): Saibal Samaddar and Tanushree Halder*

Recovering debts is a labor-intensive process that is also hugely dependent on the availability of a centralized system for tracking delinquent customers, effective credit regulations, the payment culture and the pace of the legal system of the country.

These factors make collecting loans in India very tough, but several other countries also go through the same challenges. Countries like Saudi Arabia, South Africa, China, and Mexico have a very complex debt collection environment.

In India, field agents directly contact 30% - 50% of the delinquent customers which makes the process very expensive too. The debtcollecting agencies take 10% - 30% of the loan amount being recovered depending upon the number of days the customers are delinquent. Reliance on the field agents also cost the lenders bad publicity due to multiple calls/visits made by the agents, harassing customers to make the payments by not complying with the SOPs. Globally, lenders are adopting digital methods for collections to cut down on these monetary and goodwill costs

• According to a survey, 89% of customers in the 18-35 age group and 87% in the 35-50 age group have a strong preference for digital repayment options - i.e. they want companies to reach out to them through digital channels for making the payments by not intruding into their lives.

• Digital debt collections like digital payments and IVR calling also bring cost efficiencies of up to 60%.

But even tech-savvy customers who prefer digital repayment options remain apprehensive about it due to the lack of human-like assistance in making the payments. Multiple factors like - lack of knowledge of the repayment cycle, technical issues and glitches while setting up the e-mandates and cash flow mismatch contribute largely to the delinquencies.

Conversational AI is the evolving answer to these woes:

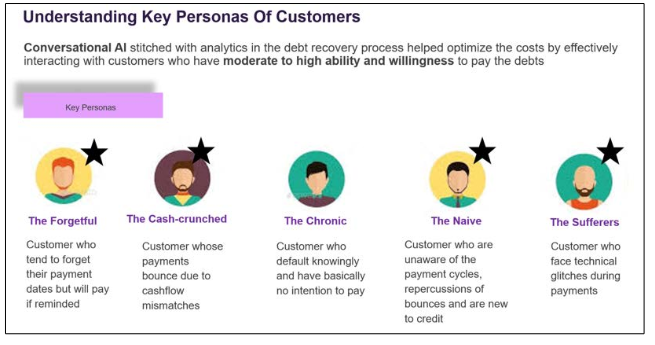

Given the limitations of not having a centralized system of tracking the whereabouts of delinquent customers, it makes sense to identify what is collectable. Except for the Chronic, the other four segments of customers are more likely to make the payments through some form of nudge and a slight bit of financial education.

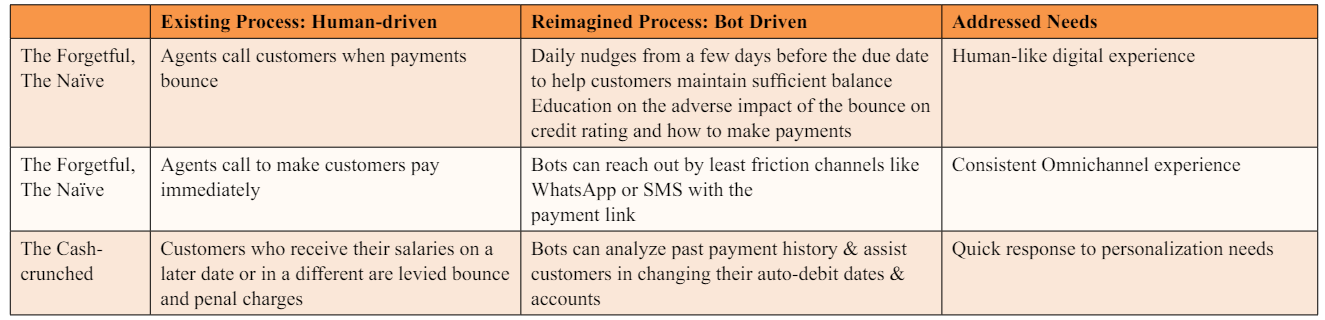

Examples of such persona-based reimagined processes are highlighted in the table below:

As evident, conversational AI analyses customer behavior to provide the best experience to the target customer during the debt recovery process.

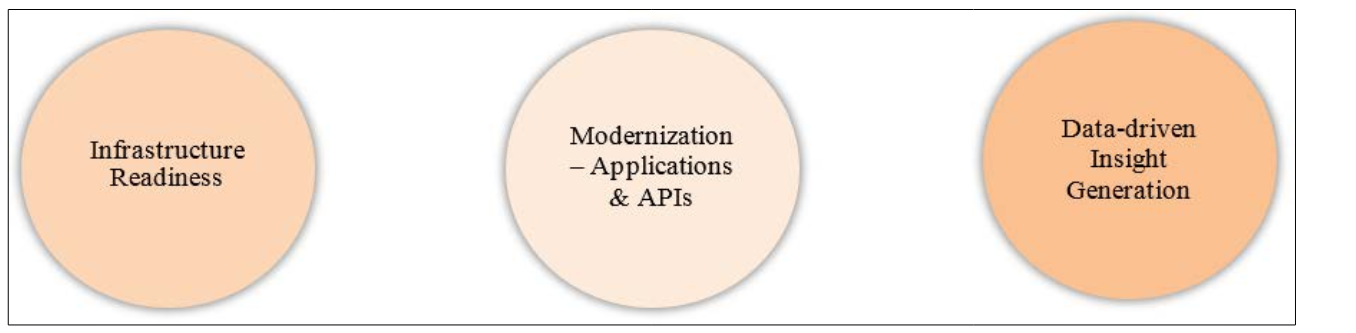

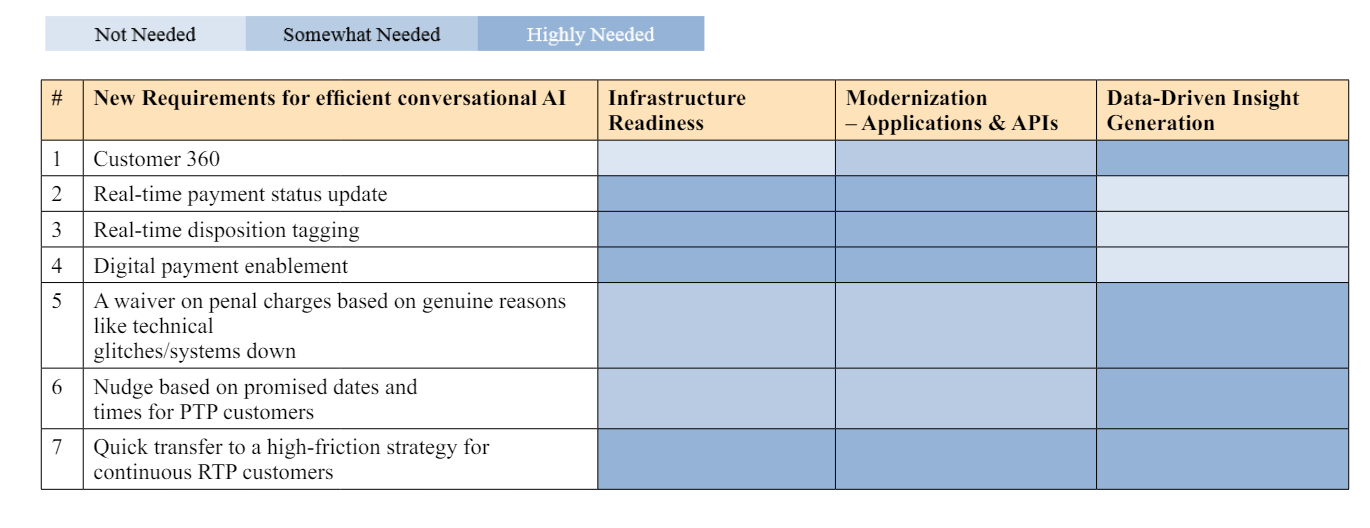

Providing a human-like experience through conversational AI requires a bi-directional, realtime information flow. To achieve this IT landscape of the organization must evolve dramatically along these three dimensions:

An illustrative heat map to show the need for these three dimensions for a seamless conversation in debt recovery:

There are multiple aspects of customer behaviour which need to be analysed before finalizing the best conversational AI journey that improves all the performance metrics of the collections process.

Imagine a bot reaches out to customers 10 times a day on WhatsApp for 7 consecutive days to make the payment and as a result customers block the WhatsApp number. As per RBI Infrastructure Readiness Data-driven Insight Generation Modernization - Applications & APIs - guidelines in India, if a business account gets blocked a certain number of times the business account gets closed on WhatsApp. Therefore, while defining the journey key decisions must be made to make the journey effective and profitable. For example:

All these questions in the conversational AI journey will not have answers on day one.

The answers lie in two things: what is allowed by the regulatory body of the country and what derives maximum value. The value can be estimated by running randomized test campaigns on homogeneous customers and finding out what works and what does not use conversion rates. The things that work can then be extended to the overall base.

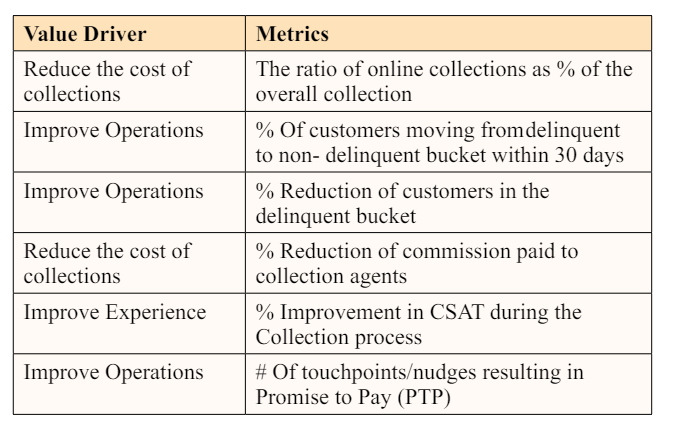

Conversational AI helps in improving most of the performance metrics of the debt-recovery process of an organization. The following metrics can help us understand the value derived from the transformation

Organizations need to analyse these metrics and benchmark with industry peers to understand the areas of improvement in the conversational AI journey

In a nutshell, Conversational AI is a technology that will help organizations in their debt recovery process by handling most of the delinquent customers - the forgetful, the cashcrunched, the naive and the sufferers - while enabling the direct contact agents (DCAs) to shift focus towards the chronic customers. This will ensure the optimization of the resources and drastically reduce costs.

The backbone of conversational AI ‘the IT Landscape’ - needs to evolve at a very fast pace to support the envisioned process transformation. Identification of data that needs to be stored, processed and analysed while complying with the regulatory requirements, data privacy policies & responsible AI norms should go hand in hand. Integration with different available APIs plays a big role in providing hyper-personalized customer engagement.

The conversational AI designs of most organizations are currently intuition-based but this will evolve over time as more and more data get added to the systems and journey decisions on preferences of the channel of the customer, most appropriate time to nudge a customer to get a successful payment, etc. become more datadriven.

Multiple test campaigns should be run to see if there is an improvement in all the collections metrics due to the decisions made on the journeys using these data-driven insights.

Finally, the success of conversational AI lies in the fact that the collections department of an organization welcomes it with open hands and rethinks its processes to augment the ability of the collection agents and collaborates closely to exchange information & data.