Author(s): Zhang Xujun* and Wang Yuede

Cold chain logistics has developed rapidly and the scale of the industry has been expanding. Go deep into the front line, the per capita cold chain resources in China’s cold chain logistics are low, there is a shortage of cold chain goods, blindly start construction in various places to expand storage and transportation capacity, the lack of top-level overall planning and design of industry development, repeated construction, uneven distribution of cold chain logistics service capabilities, lack of efficient and unified information sharing platform, imperfect information sharing mechanism, unsmooth flow of market information, insufficient support from industry authorities, poor stability of industry development and other prominent problems, and analyze their causes. Based on this, it is proposed to strengthen the source pull, promote the healthy development of cold chain logistics, coordinate the construction of resources, promote the rational and scientific layout of cold storage, establish a cold chain information sharing platform, promote smooth information communication across

the network, strengthen industry support, and enhance development momentum and social benefits.

Keywords: Cold Chain Logistics, Service Capabilities, Information Sharing Platform, Development Momentum, Big Data, Countermeasures

In recent years, with the rapid development of China’s economy, the demand for cold chain transportation in the whole society has increased day by day: in 2015, the national cold chain transportation business volume has exceeded 100 million tons, the cold chain logistics industry has grown at a rate of 14% in recent years, and 23.5% in 2019, the demand is 233 million tons, and the refrigerated vehicles are 210,000 units, a year-on-year increase of 19.3%. In 2021, China’s cold chain logistics market will reach 418.4 billion yuan, refrigerated warehouses and 287,000 refrigerated vehicles. During the “14th Five-Year Plan” period, there will be more than 100 backbone cold chain enterprises in China, and the market size of cold chain logistics will exceed 100 billion. The China Cold Chain Logistics Society predicts that during the “14th Five-Year Plan” period, the average growth rate of China’s cold chain logistics market will reach 15%, and it is expected to exceed 636.3 billion yuan in 2024. Agricultural products such as fruits, vegetables, aquatic products, etc., due to their perishability and fragility, are very easy to cause loss and deterioration due to the external environment during storage and transportation, and must be preserved by cold chain logistics.

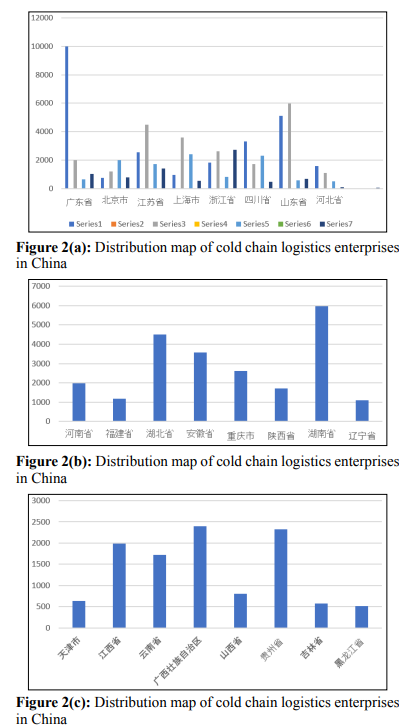

Using the keyword “cold chain” to query on Qichacha (https:// www.qcc.com/), it was found that as of September 18, 2022, there were 67,461 domestic companies involved in cold chain manufacturing, leasing, logistics, wholesale and retail, and the number of registrations in Guangdong Province was as high as 10,000, ranking first, followed by Hunan and Shandong, as shown in Tables 1 and 2. According to data from China Internet of Things, in 2018, 90% of China’s cold chain logistics was onshore cold chain, 8% was sea transportation, and 1% was railway

| Province | Guangdong Province |

Beijing | Jiangsu Province |

Shanghai | Zhejiang Province |

Sichuan Province |

Shandong Province |

Hebei Province |

|---|---|---|---|---|---|---|---|---|

| Number of businesses |

10000 | 767 | 2558 | 963 | 1820 | 3296 | 5116 | 1572 |

| province | Henan Province |

Fujian Province |

Hubei Province |

Anhui Province |

Chongqing City |

Shaanxi Province |

Hunan Province |

Liaoning Province |

| Number of businesses |

1982 | 1187 | 4503 | 3574 | 2614 | 1714 | 5964 | 1107 |

| province | Tianjin City | Jiangxi Province |

Yunnan Province |

Guangxi | Shanxi Province |

Guizhou Province |

Jilin Province | Heilongjiang |

| Number of businesses |

640 | 1987 | 1721 | 2398 | 812 | 2320 | 574 | 520 |

| province | Inner Mongolia |

Xinjiang | Gansu Province | Hainan | Ningxia | Qinghai Province |

Tibet | Hong Kong |

| Number of businesses |

1028 | 796 | 1397 | 544 | 2731 | 485 | 673 | 79 |

Source of quantity: Qichacha website, https://www.qcc.com/, as of September 18, 2022.

Source: Qichacha website, https://www.qcc.com/, as of September 18, 2022.

China’s refrigerated inventory continues to grow. According to the statistics of the Prospective Industry Research Institute, in recent years, due to the increase in market demand and the support of national policies, China’s cold storage capacity has been maintained at more than 10% in recent years. In 2019, the total amount of cold storage in China reached 60.53 million tons, equivalent to 140 million cubic meters, a year-on-year increase of 15.6%. The cold storage capacity in developed countries is basically more than 3,000 cubic meters / 10,000 people, and the per capita cold storage capacity in the United States is 4,900 cubic meters / 10,000 people in 2019. It can be seen that China’s per capita cold storage capacity is still far from the world’s advanced countries. At present, the domestic development is very uneven, and the cold storage capacity of different regions varies significantly: Shanghai has the highest per capita cold storage capacity in the country, reaching 3865 cubic meters / 10,000 people in 2018, reaching the level of developed countries. However, there are still 17 provinces with a per capita cold storage capacity of less than 1,000 cubic meters [1-5].

Production cold storage, freezing, ice making and other production equipment are an important part of food production and processing enterprises, such as aquatic product processing plants, meat processing plants, fruit and vegetable processing plants, quick-frozen food factories and dairy processing plants. Due to the continuous improvement of China’s industrial structure adjustment, environmental protection and epidemic prevention measures, aquaculture industry is gradually migrating to areas suitable for production, and becoming more and more centralized, large-scale and standardized, and the continuous expansion of the distance between production and consumption is bound to cause the existing circulation system to be difficult to adapt, and full cold chain circulation is an inevitable trend.

Logistics refrigerated warehouses are generally located in wholesale markets or logistics parks to facilitate centralized storage of goods before distribution. At present, more than 70% of the country’s agricultural products are circulated in the form of wholesale markets. Caught aquatic products pass through multi-tiered wholesale markets, eventually to the retail market, and finally to consumers. Since this model involves many cold chain and logistics links, aquatic products must reach the end consumer for a long time. In different agricultural products wholesale markets, if the supporting facilities of cold storage are not enough, it will cause the loss of aquatic product quality. At present, major supermarkets in China have corresponding supporting cold storage, which accounts for the highest proportion of cold storage in China.

Cold chain logistics informatization and intelligence are important guarantees for improving the technology of aquatic products cold chain logistics industry, strengthening the quality of cold chain logistics process products, reducing cold chain production costs, and promoting the development of enterprise brands.

In terms of standardization construction, as of the end of August 2019, 283 cold chain logistics standards have been formulated nationwide. At present, there are still some problems in China’s warehousing preservation and cold chain logistics standard system. For example, the temperature control of the cold storage platform and the management specifications of the pre-cooling process of aquatic products in the production area are not perfect, and the different guidelines overlap in content and conflict in concept.

The economic development process of Western developed countries shows that when the per capita GDP exceeds $4,000, the frozen and refrigerated products market will show the characteristics of rapid development. In 2021, the country’s per capita GDP was 810,000 yuan (RMB), equivalent to 1 US dollar270,000 yuan, indicating that China’s refrigeration and refrigeration market has entered a period of rapid development. China is a country dominated by agriculture and agricultural products, and more than 50% of perishable food is transported through the cold chain every year. In addition, the development trend in recent years shows that the public’s awareness and consumption level of fresh frozen food are increasing, and the growth rate is expected to remain at 15% to 20% per year. The rapid development of fresh e-commerce has become a tipping point for the explosive growth of cold chain logistics, while the live pig and poultry embargo policy in response to the African swine fever epidemic and the new crown pneumonia epidemic has further increased the demand for cold chain logistics facilities. The combined effect of these factors makes China’s cold chain logistics industry have huge room for development [5-8].

At present, China’s cold chain logistics is facing four prominent problems: first, the contradiction between the lack of cold chain commodities nationwide and the blind expansion of storage capacity; Second, industrial development lacks top-level overall planning and planning, and the distribution of duplicate construction and cold chain logistics service capabilities is unbalanced; Third, there is a lack of an effective and unified information sharing platform, an imperfect information sharing mechanism, and an unsmooth flow of market information; Fourth, the support of the industrial management authorities is insufficient, and the stability of industrial development is poor.

First, aquaculture production declined. Cold chain logistics in coastal areas is dominated by seafood. Since 2013, the coastal area has vigorously promoted the development concept of “Jinshan Yinshan”, thoroughly cleaned up heavily polluted coastal fish row farms, and improved the marine environment. However, many places have eliminated low-end farms and failed to cultivate high-end scientific research farms in time, resulting in a sharp decline in the receipt of cold chain logistics enterprises. According to feedback from some heads of marine aquaculture enterprises, due to the impact of marine aquaculture and the fishing moratorium, the annual seafood production of enterprises has dropped significantly, and the demand for refrigerated warehouses has also fallen by more than half. The second is the effect of the fishing moratorium. According to the relevant regulations of the Ministry of Agriculture and Rural Affairs on the marine fishing moratorium in the middle of the season, all waters in China have implemented a fishing moratorium system of more than three months, such as Guangdong’s fishing moratorium from May to the end of August, a period of 108 days. During the fishing moratorium, local seafood production almost stagnated, and only some frozen food from abroad required a small amount of cold chain logistics. A certain place in Guangdong is a leading enterprise specializing in aquaculture, processing, cold chain logistics and other industries, with a history of more than 20 years. According to the person in charge of the enterprise, during the fishing ban period, the utilization rate of the cold storage with 900 tons of storage capacity of the company was reduced by more than 50%, and the cold storage in use only accounted for 40% of the total storage capacity; There are more than 20 refrigerated trucks, the average utilization rate has been reduced by 60%, and only 5-6 are currently used for transit. The cold chain logistics sector experienced huge losses, which caused huge losses for the company. Third, the regulation of fishing vessels is becoming increasingly stringent. In order to combat illegal fishing, fishery authorities have strictly supervised fishing vessels, requiring vessel owners to provide fishing licenses, business licenses, identity cards and other documents when selling products, and the owner’s signature, and the procedures are very strict. As a result, both formal companies and private fishing vessels have either reduced fishing trips or resold foreign merchants overseas, resulting in a decline in demand for local cold chain logistics.

Taking Guangdong as an example, there are 28,700 cold storage warehouses in Guangdong, including farmers’ markets, with a total storage capacity of more than 5.5 million tons, and there is a problem of space imbalance. First of all, the scale distribution of cold storage in various regions is uneven, coastal aquatic products are abundant, and cities with many ports, such as Guangzhou, Zhanjiang, Yangjiang, and Shantou, the number of cold storage has reached more than 17,000, and the inventory has reached three million tons, accounting for more than 50% in the province. Guangzhou and Shenzhen have a high concentration of import counters, for example, the special inventory of meat and chilled aquatic products imported in the two cities accounts for more than 70% of the province; Cold storage in inland cities such as Jieyang, Shaoguan, Heyuan, and Zhongshan is small in scale and widely distributed. Secondly, the distribution of urban and rural cold storage in China is unbalanced, mainly reflected in: there are more urban market type and processing type large cold storage, while in rural areas near fresh production areas, the number of high-temperature cold storage is small, and the single storage capacity is smallThe construction of high-temperature cold storage is insufficient, and the delicate products have a high corrosion rate. For example, lychees in a certain area, due to the lack of pre-cooling, after two days of high-temperature transportation and storage, its decay rate reached 20%, causing serious economic losses. Third, from the perspective of high and low temperature cold storage, at present, domestic cold storage is dominated by low temperature cold storage, coastal cities are mainly large-scale warehousing and logistics, and the construction of supporting small storage circulation cold storage is not standardized.

At present, the concentration of China’s cold chain logistics industry is low, and a unified and efficient information platform between origin, cold storage enterprises, transportation enterprises, distributors and other subjects has not yet been established, and the phenomenon of “information island” is prominent, which has an adverse impact on the resource allocation of enterprises. First of all, it is impossible to reasonably allocate cold storage resources, and logistics costs increase. For example, the rent of cold storage in Guangzhou and Shenzhen is between 4-6 yuan / ton, the rent of cold storage in western Guangdong is 2.5 yuan / ton / day, and Zhanjiang is between 3.5 yuan / ton because of the large demand for cold storage in the aquatic market. Due to the untimely flow of information, enterprises cannot rationally allocate resources between regions. The establishment of a unified and efficient industry marketing information platform allows enterprises to obtain relevant information in a timely manner, arrange warehouses reasonably according to different supply cycles, and reduce costs. Secondly, the supply and demand relationship of cold chain logistics in China is opaque and expensive. The greater the demand for refrigerated trucks, the more there are enough vehicles, the less return empty load rate, and the lower the cost. Taking Guangdong Province as an example, although it is located in the largest province in the country, the problem of economic development imbalance is more prominent, the economic gap between the Pearl River Delta and the eastern and northwestern regions of Guangdong is large, the return vehicle volume of the Pearl River Delta is large, the empty load rate is low, and the overall logistics cost is low, while the transportation vehicles in eastern and northwestern Guangdong are relatively high. The information platform can realize the transparency of demand information in various regions, obtain demand information in a timely manner, and flexibly allocate goods, thereby effectively reducing the deformed empty driving rate of vehicles.

Affected by the new crown pneumonia epidemic, overseas cold chain food tests are often positive, resulting in increasingly strict cold chain control, which has a great impact on its operations. After the outbreak of the epidemic, the number of ships at home and abroad has decreased sharply, the pattern of supply and demand has undergone tremendous changes, and the contradiction between supply and demand has become increasingly serious. In some countries and regions, the price of sea freight has risen eightfold. Shipping schedules in most countries and regions are volatile, with ships arriving within a week often delayed by one to two weeks, and cargo piles up due to frequent schedule changes. Seafood goods are easy to spoil, and cargo owners can’t wait to deliver as soon as possible, which makes it “difficult to find a cabinet”. In addition, the port epidemic prevention system stipulates that different goods need to be operated at fixed points, which increases the need for work procedures and on-site office. For example, Hong Kong’s export business needs to add office space in Shenzhen Port; Export procedures are cumbersome, customs clearance times are long, and in addition to additional costs, the chances of damage to goods are greatly improved. Secondly, China’s tax authorities have made new provisions on the tax rebate policy for export enterprises, which has made the export tax rebate procedures more complicated, the tax rebate cycle prolonged, and the time consumption increased. According to feedback from some companies, they completed the export tax rebate declaration in April 2020, but only received the tax refund payment in September 2021; The application submitted in October 2021 has been like a mud cow into the sea, and repeated inquiries to the competent authorities have been unsuccessful, and the company is unclear about which link has gone wrong, and its enthusiasm has been seriously frustrated. Third, the financial management level has increased, and the burden of enterprise management is heavier. For example, the competent authorities at a higher level have issued regulations requiring enterprises to attach various supporting documents such as industry business licenses, staff health certificates, quarantine certificates, and ID cards when purchasing agricultural products, and only when the prescribed documents are complete can invoices be issued, which increases the difficulty of enterprise administration and makes it more difficult for enterprises to obtain invoices.

Implement the concept of “green water and green mountains are golden mountains and silver mountains”, strengthen scientific layout, change breeding methods, improve breeding environment, strengthen production supervision, broaden development space, strengthen policy support and implement safeguard measures, accelerate the recovery of aquaculture industry, ensure source demand for the healthy development of cold chain logistics, and add sustained demand pull. Vigorously promote the large-scale, intensive and green development of the aquaculture industry, and effectively reduce the impact of the reduction of distant marine production on cold chain logistics during the fishing ban period. Strengthen regional linkage, simplify management procedures, and escort the healthy development of fisheries [8-10].

With the construction of the national backbone cold chain logistics base as the traction, strengthen the construction of production and marketing cold chain distribution centers, city, county (district) central cold storage, and urban low-temperature distribution and disposal bases, and make up for the shortcomings of cold chain logistics facilities at both ends. For example, Guangdong should strengthen the construction of cold chain logistics facilities in agricultural product production areas, focus on Shanwei, Zhanjiang, Yangjiang, Jiangmen, Foshan, Guangzhou and other aquatic product production areas, improve the low temperature and ultra-low temperature storage, transportation, packaging and processing systems of aquatic products, build low-temperature cold storage (-18 °C˜0 °C) for aquatic product processing and storage, and ultra-low temperature cold storage (-60°C) suitable for the storage and processing of high-value-added aquatic products caught in distant waters such as tuna, and build a number of provincial important aquatic products cold chain logistics bases. Focusing on Maoming, Zhanjiang, Zhaoqing, Meizhou, Guangzhou, Qingyuan and other fruit and vegetable producing areas, combined with the layout of cold chain facilities in fruit and vegetable producing areas, rationally utilizing the existing scattered and small cold storage in the production areas, and focusing on the construction of large and medium-sized freshkeeping warehouses (0°C˜4°C) that can provide services such as fruit and vegetable pre-cooling, sorting, packaging, storage and preservation in the main producing areas. Focusing on Yunfu (Wen’s) and Qingyuan (Shuanghui, Tiannong), actively promote the development of cold chain logistics of meat and agricultural products, improve meat cold chain logistics facilities covering the entire process of production, storage, transportation and sales, and build a number of provincial important meat cold chain logistics bases [10-14].

On the basis of the “cold chain communication” information platform that has been built in the cold chain logistics industry, blockchain technology is introduced to build an intelligent integrated service platform for cold chain logistics, and warehousing information, supply and demand information, and price information are uploaded to the platform in a timely manner, so as to improve the speed of information flow and logistics efficiency, realize the dynamic allocation of cold chain resources in the province, increase the flexibility of the supply chain, improve the emergency mechanism of the optimization system, improve the utilization efficiency of cold chain logistics resources, shorten the delivery time, and reduce operating costs. Establish an advanced information tracking and traceability system to accurately locate the problem of broken chain in the middle of cold chain logistics in order to solve it in time.

Since the outbreak of the epidemic, export freight rates have continued to rise, up to 8 times. The schedule is very unstable, and “one container is difficult to find”. Taking export to Hong Kong as an example, enterprises need to set up additional office space at the Shenzhen port for connection. Cumbersome export procedures and longer customs clearance times greatly increase the likelihood of damage to goods, in addition to additional costs. The export tax rebate procedures of foreign trade enterprises are complicated, the cycle is too long, and the time cost is too high. According to the company, the export tax rebate application was submitted in April 2020 according to the regulations, and it did not arrive until September 2021; The application submitted in October 2021 has been like a mud cow into the sea, and repeated inquiries to the competent authorities have been unsuccessful, and the company’s heart is cold. For example, enterprises are required to purchase agricultural products with supporting documents such as industry licenses, health, quarantine, and identity, and issue invoices, and at the same time it is difficult for enterprises to obtain invoices.

Government authorities need to further strengthen service awareness and support the healthy development of industry enterprises. First, epidemic prevention and control should be implemented according to the city, not “one-size-fits-all”, on the basis of safety, open up green export channels, improve export customs clearance efficiency and service quality, and provide government credit guarantees for enterprise exports. The second is to simplify export tax rebate procedures, improve work efficiency and information transparency, facilitate enterprises to obtain information in real time, and improve the capital turnover and utilization efficiency of enterprises. The third is to introduce fiscal and tax support measures for market segments, such as unifying the requirements and standards at all levels, optimizing unnecessary procedures, simplifying information, and facilitating taxpayers. Improve tax incentives for regular maintenance and transformation of cold chain logistics facilities and equipment, and release water to raise fish; Taxed according to the actual gross profit margin of the industry, do everything possible to help enterprises bail out and improve social benefits.