Author(s): Goutham Sabbani

Cloud Computing, Investment Management, Data Management, Financial Analytics, Artificial Intelligence (AI), Machine Learning (ML)

Cloud has transformed human lives in various ways, reducing operational costs, increasing efficiency, and improving accuracy. This resulted in a 40% increase in multiple operations. One notable example is Netflix, a primary global service provider, which uses Amazon Web Service(AWS) to manage its vast content library, ensuring smooth and efficient streaming services to millions of users with the help of cloud computing. Netflix can scale up or down resources based on demand, optimizing performance and efficiency [1,2].

The evolution of cloud computing in the finance sector firstly, they were hesitant to adopt cloud computing technology because of compliance issues, security issues, and data privacy. After this, cloud providers have developed their security measures and compliance frameworks, and more financial institutions have embraced the cloud to stay agile rapidly in the environment.

Here is a line graph showing the adoption of cloud computing in the finance sector

Source: Cloud Computing Adoption Challenges in the Banking Industry [3].

Evolution of Cloud Computing in Investment Management The early stages of investment management began by adopting essential cloud services such as data storage and computing power. For instance, many financial institutions have adopted AWS and Microsoft Azure. This transition has improved accuracy and efficiency without the substantial capital investment required for on-premise solutions.

The most recent advancement of cloud computing in investment management is support for complex financial analytics and advanced decision-making. Cloud computing leverages sophisticated algorithms and large-scale data analytics to make informed investment decisions. Morgan Stanley uses complex financial models and simulations to support trading decisions and investment strategies [4].

Here is a line graph showing speed improvement by cloud computing in the financial sector

Source: Adoption of Cloud Computing and Modelling [2].

Cloud computing has significantly transformed data management and analysis, especially in finance. These developments include the ability to handle vast amounts of data, increasing speed and accuracy, and providing support for complex financial analytics and decision-making processes.

The primary benefit of cloud computing is collecting extensive data because financial organizations place high importance on data that should be held, processed, and interpreted in real time. Cloud providers like Amazon Web Services and Microsoft Azure offer scalable storage and powerful computational capabilities, allowing financial institutions to handle this data effectively [5].

For instance, JP Morgan, one of the world's most significant investment banks, has integrated cloud computing technology. This resulted in managing its vast datasets, enabling the bank to process large amounts of financial data swiftly and efficiently. Morgan resulted in a 30% increase in data processing efficiency and a 20% reduction in data storage costs since migrating to cloud-based infrastructure [6].

Cloud computing has developed the speed and accuracy of data processing and analysis. Financial institutions can perform complex calculations and analyses much faster using leveraged distributing computing services than traditional on-premises systems. This speed is crucial for trading, risk assessment, and market analysis.

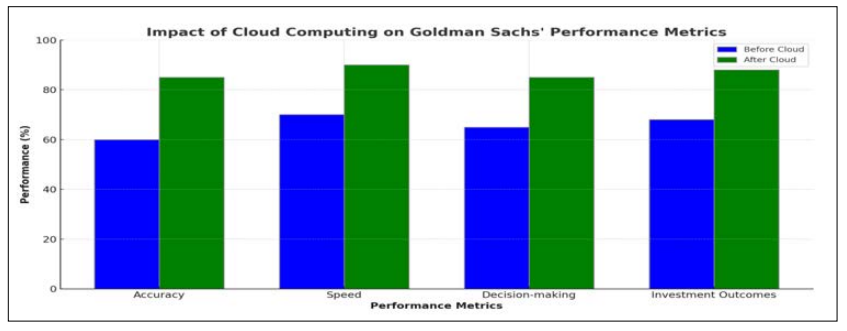

Here is a bar graph comparing improvements in cloud computing. The chart compares various performance metrics like decision- making and investment outcomes.

Source: Goldman Cloud Computing Case study [6].

Artificial intelligence and machine learning have become essential parts of cloud computing for modern cloud providers' platforms, transforming investment management by providing predictive insights and improving investment strategies.

AI and ML technologies are pivotal in enhancing the capabilities of cloud platforms. They scale vast data processing, providing financial institutions with actionable insights and making informed decisions. For instance, Google Cloud services include AutoML, BigQueryML, and TensorFlow, which help financial institutions quickly deploy machine learning models. These helps automate data analysis and generate predictive ideas, making them invaluable for investment management.

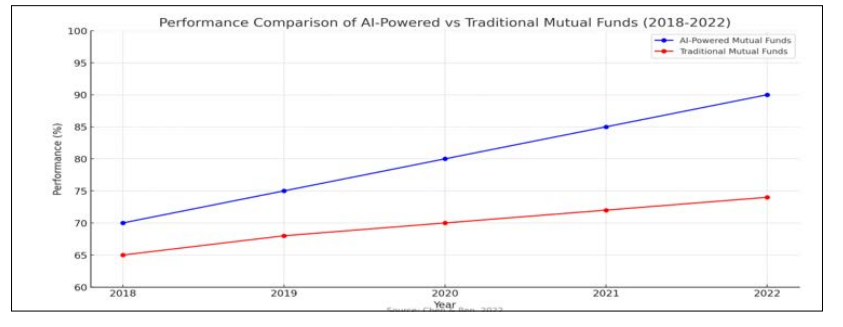

Here is a line graph comparing the performance of AI-powered V/ S traditional mutual funds

Source: Artificial Intelligence Modelling Framework [7].

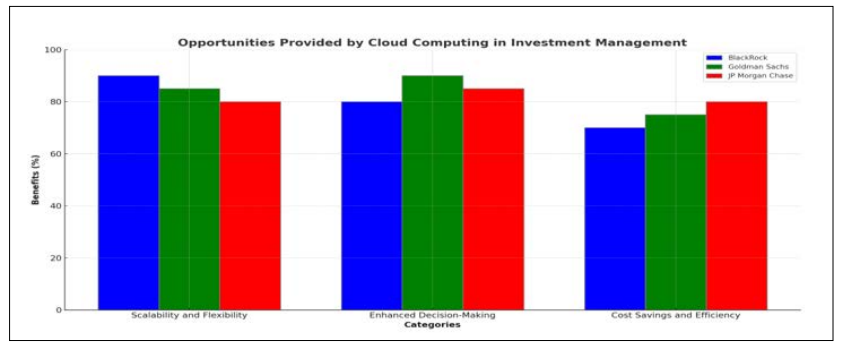

Cloud computing offers various chances for investment management, including scalability and flexibility, enhanced decision-making capabilities, and significant cost savings and efficiency improvements. Some key benefits are scalability and flexibility. Cloud computing provides unparalleled scalability and flexibility, allowing investment companies to adjust resources based on current needs. For instance, the world's most significant AUM, Blackrock, uses cloud services to scale the Aladdin platform, which includes handling portfolio management, risk analysis, and trading.

AI and ML are integrated with cloud computing to provide advanced analytics, enabling firms to make better, data-driven costs. These technologies can provide real-time predictive insights and uncover hidden patterns that inform investment strategies. Goldman Sachs uses cloud-based AI and ML tools, enabling firms to make better, data-based decisions by analyzing market trends and predicting future movement. These tools helped Goldman Sachs optimize trading strategies and improve investment outcomes [8].

Source: Do AI-Powered Mutual Funds Perform Better [3].

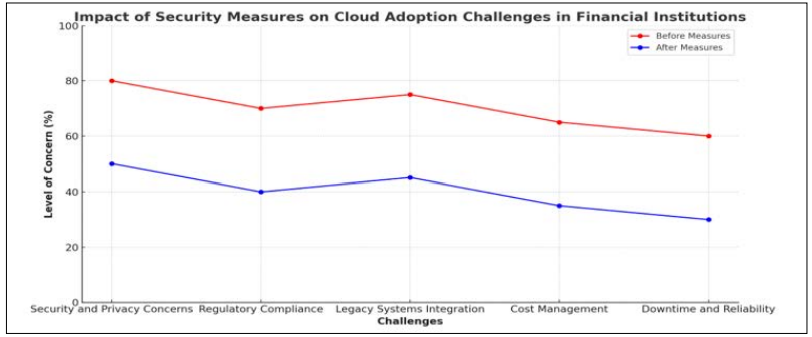

One of the primary challenges in adopting cloud computing is the concern of security and privacy data. Financial institutions have a high volume of confidential and sensible data, and their fear of data breaches or unauthorized access can make them hesitant to move to the cloud. The financial sector is heavily regulated, which can be challenging when adopting cloud services. Ensuring that cloud providers meet all regulatory requirements is one of the significant barriers for financial institutions.

Financial institutions can integrate advanced security measures such as encryption, two-factor authentication, and continuous monitoring to tackle security concerns. Choosing reputable cloud services with strong security cloud service providers can protect our system.

Source: The Business Intelligence as a Service in the Cloud [9].

The above line chart shows the impact of security measures on cloud adoption in financial institutions.

For Instance, one of the largest financial management companies in the world, has successfully implemented cloud computing to enhance its operations, security, and efficiency. Handling large amounts of economic data has opened concerns for security breaches and unauthorized access. Managing the costs of cloud providers was a crucial consideration. Maintaining compliance with strict financial regulations while migrating to the cloud was a critical challenge.

The bank employed cost management practices such as monitoring usage and optimizing resource allocation to control expenses. Morgan implemented advanced encryption, multifactor authentication, and continuous monitoring to secure its data [10].

Cloud computing has profoundly changed asset control by improving efficiency, lowering prices, and revving time-to-market. Economic organizations can take vast datasets with improved velocity and precision through advanced data management. Combining AI and ML in shadow media delivers predictive senses and optimizes asset systems.

Despite safety problems and regulatory submissions, monetary institutions can mitigate these by executing state-of-the-art safety standards and selecting respected cloud providers. Thriving cases, such as JP Morgan Chase and Goldman Sachs, emphasize the benefits of significant advances in data processing efficiency and decision-making capabilities.

As cloud technology continues to evolve, it offers unparalleled opportunities for scalability, flexibility, and innovation in investment management, reshaping the industry and driving future growth. The strategic adoption of cloud computing is essential for financial institutions to remain competitive and agile in a rapidly changing environment.