Author(s): Abhishek Shende*, Satish Kathiriya and Rajath Karangara

This paper explores the transformative potential of Artificial Intelligence (AI) and Generative AI in reshaping the title industry, particularly in mortgage origination. By analyzing historical challenges, including the subprime mortgage crisis and the inefficiencies of traditional title systems, juxtaposed with modern AI-driven solutions, we highlight the paradigm shift towards technology-centric operations. We examine AI's role in addressing issues such as lost chains of title, complex legal frameworks, and outdated land title recording practices. The research emphasizes AI's capacity for streamlining processes, enhancing accuracy in title searches, and mitigating fraud risks. This study not only delves into AI's operational impact but also considers legal, ethical, and data security implications, underscoring the need for balanced and informed integration of AI technologies in the title industry. The findings suggest a future where AI and Generative AI fundamentally alter traditional practices, offering increased efficiency, reliability, and transparency in mortgage origination processes.

The title industry, vital for ensuring secure and legitimate real estate transactions, has historically been steeped in traditional, laborintensive processes. With roots stretching back over a century, the industry has faced numerous challenges, including inefficiencies in title searches and vulnerability to fraud. In recent years, the emergence of Artificial Intelligence (AI) and Generative AI has presented unprecedented opportunities for modernization. These technologies promise to revolutionize the industry by automating complex tasks, enhancing accuracy, and significantly reducing processing time.

This paper aims to delve into the transformative impact of AI and Generative AI in the title industry, particularly focusing on mortgage origination. By examining historical industry challenges, the technological evolution of AI, and its specific applications in title searches and mortgage processing, the paper seeks to provide a comprehensive analysis of AI's role in shaping the future of the title industry. It also considers the legal and ethical implications of integrating such advanced technologies, underscoring the importance of a balanced approach to innovation [1-3].

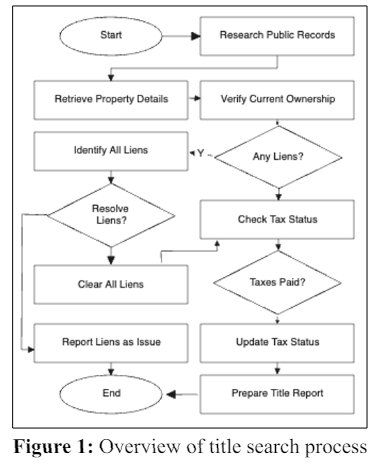

As depicted in Figure 1, traditional title systems are marked by manual, paper-based processes, involving extensive searches through public records to verify ownership and identify any liens or encumbrances on the property. This system, while thorough, is time-consuming, prone to human error, and lacks standardization, leading to inconsistencies across different jurisdictions [2,3].

The subprime mortgage crisis highlighted the vulnerabilities of the title industry, particularly in managing foreclosure processes and ensuring clear titles. This period saw a surge in title claims, reflecting the complexity and risks inherent in the industry's practices during times of financial instability [1,4].

Conventional practices in the title industry, while reliable to an extent, suffer from inefficiencies such as prolonged processing times and a high potential for errors. The reliance on local knowledge and manual record-keeping systems further exacerbates these issues, hindering the industry's ability to adapt to increasing demands and changing market conditions.

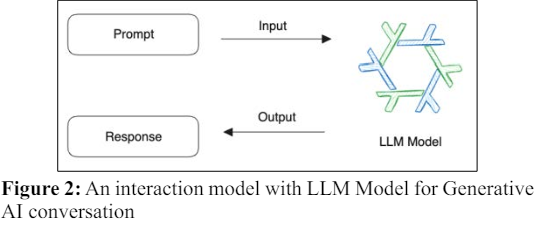

AI and Generative AI represent a leap forward in computational technology, characterized by their ability to process vast amounts of data, learn from patterns, and even generate new content. These technologies have the potential to automate complex analytical tasks and provide insights far beyond human capabilities. As depicted in Figure 2, these technologies enable simpler interaction model based on the vast knowledge base embedded in LLM models.

In the title industry, AI can streamline title searches, enhance accuracy, and reduce processing times. Generative AI, in particular, has the potential to revolutionize document analysis and risk assessment processes, thereby improving the efficiency and reliability of mortgage origination [1,5].

Various industry case studies demonstrate the practical application of AI in title searches and mortgage origination. These include AIdriven data extraction, risk assessment models, and automation of repetitive tasks, leading to significant operational improvements [2].

The integration of AI in the title industry raises several regulatory challenges. Ensuring compliance with existing real estate and financial laws, while adapting to the capabilities of AI, is crucial. This includes navigating the complexities of property law, data use regulations, and industry-specific legal frameworks [3,4].

Ethical considerations in deploying AI involve addressing biases in AI algorithms, ensuring transparency in AI-driven decisions, and maintaining professional integrity. It's essential to consider the ethical implications of automated decision-making and its impact on stakeholders [1,2].

With AI's reliance on data, concerns regarding data security and privacy are paramount. The industry must address the protection of sensitive personal and financial information, ensuring robust cybersecurity measures are in place to prevent data breaches and misuse [5].

AI integration in the title industry is expected to lead to significant advancements. Trends indicate a move towards more automated, efficient, and error-free title processing. Predictive analytics could enable better risk assessment and decision-making [2,5].

AI promises not only to streamline existing processes but also to innovate new methods for handling title searches and mortgage origination. This potential for disruption could reshape the industry landscape, offering more agile and customer-centric solutions [1,4].

While AI introduces efficiency, the importance of human expertise remains. Balancing AI technology with professional judgment will be crucial for maintaining accuracy, ethics, and customer relations. This synergy between technology and human skills is essential for the sustainable evolution of the industry [3].

This paper highlights the transformative impact of AI and Generative AI in the title industry, emphasizing their potential to enhance efficiency, accuracy, and security in mortgage origination processes.

It is recommended that the title industry embrace AI technologies, invest in training and development, and establish guidelines for ethical and secure AI use. Collaboration with regulatory bodies to ensure compliance and foster innovation is also crucial.

The integration of AI in the title industry is an ongoing journey. Future research should focus on long-term implications, evolving legal landscapes, and the development of more sophisticated AI tools to address industry-specific challenges.